Summary

Fairness and efficiency have become the pillars of modern fair division research, but prior work on achieving both simultaneously is largely limited to the unconstrained setting. We study fair and efficient allocations of indivisible goods under additive valuations and various types of allocation feasibility constraints, and demonstrate the unreasonable effectiveness of the maximum Nash welfare (MNW) solution in this previously uncharted territory. Our main result is that MNW allocations are 1/2-envy-free up to one good (EF1) and Pareto optimal under the broad family of (arbitrary) matroid constraints. We extend these guarantees to complete MNW allocations for base-orderable matroid constraints, and to a family of non-matroidal constraints (which includes balancedness) using a novel "alternate worlds" technique. We establish tightness of our results by providing counterexamples for the satisfiability of certain stronger desiderata, but show an improved result for the special case of goods with copies (Gafni et al. 2023). Finally, we also establish novel best-of-both-worlds guarantees for goods with copies and balancedness.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

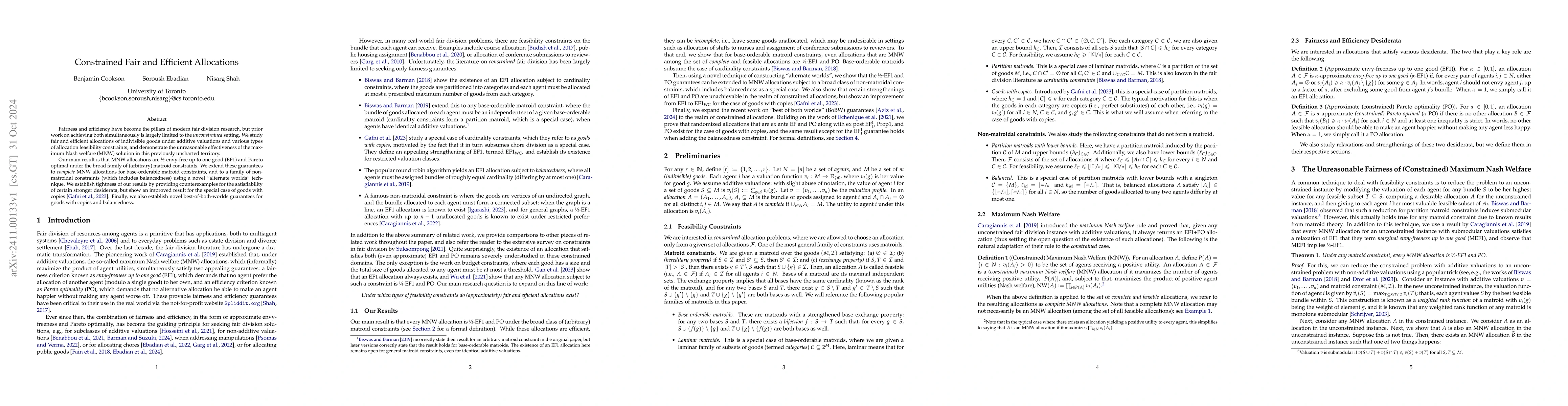

PDF Preview

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)