Summary

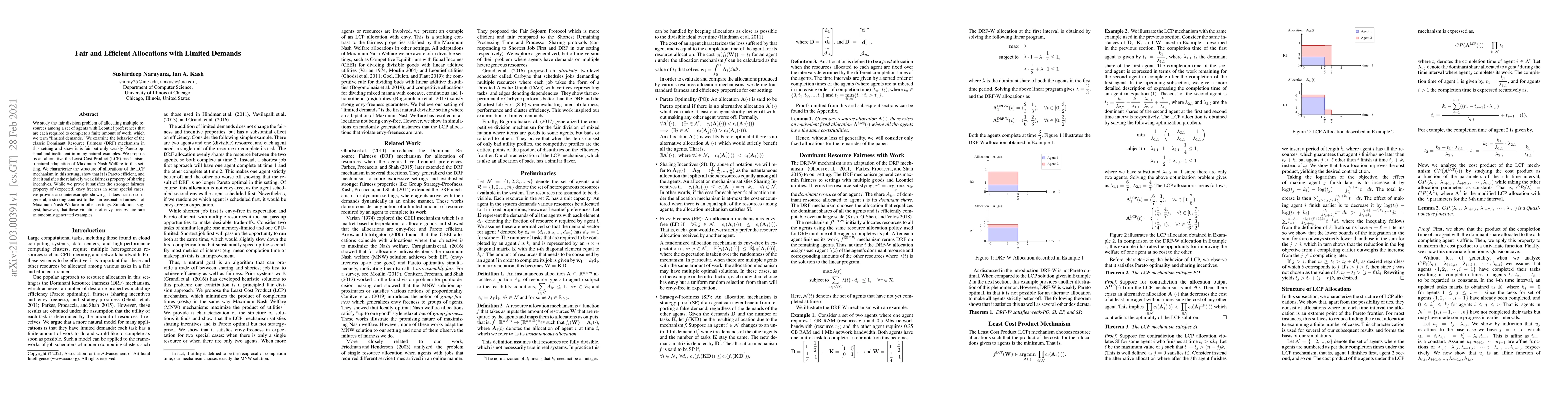

We study the fair division problem of allocating multiple resources among a set of agents with Leontief preferences that are each required to complete a finite amount of work, which we term "limited demands". We examine the behavior of the classic Dominant Resource Fairness (DRF) mechanism in this setting and show it is fair but only weakly Pareto optimal and inefficient in many natural examples. We propose as an alternative the Least Cost Product (LCP) mechanism, a natural adaptation of Maximum Nash Welfare to this setting. We characterize the structure of allocations of the LCP mechanism in this setting, show that it is Pareto efficient, and that it satisfies the relatively weak fairness property of sharing incentives. While we prove it satisfies the stronger fairness property of (expected) envy freeness in some special cases, we provide a counterexample showing it does not do so in general, a striking contrast to the "unreasonable fairness" of Maximum Nash Welfare in other settings. Simulations suggest, however, that these violations of envy freeness are rare in randomly generated examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConstrained Fair and Efficient Allocations

Nisarg Shah, Soroush Ebadian, Benjamin Cookson

Sequential Fair Allocation of Limited Resources under Stochastic Demands

Christina Lee Yu, Siddhartha Banerjee, Sean R. Sinclair et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)