Authors

Summary

We investigate stochastic utility maximization games under relative performance concerns in both finite-agent and infinite-agent (graphon) settings. An incomplete market model is considered where agents with power (CRRA) utility functions trade in a common risk-free bond and individual stocks driven by both common and idiosyncratic noise. The Nash equilibrium for both settings is characterized by forward-backward stochastic differential equations (FBSDEs) with a quadratic growth generator, where the solution of the graphon game leads to a novel form of infinite-dimensional McKean-Vlasov FBSDEs. Under mild conditions, we prove the existence of Nash equilibrium for both the graphon game and the $n$-agent game without common noise. Furthermore, we establish a convergence result showing that, with modest assumptions on the sensitivity matrix, as the number of agents increases, the Nash equilibrium and associated equilibrium value of the finite-agent game converge to those of the graphon game.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

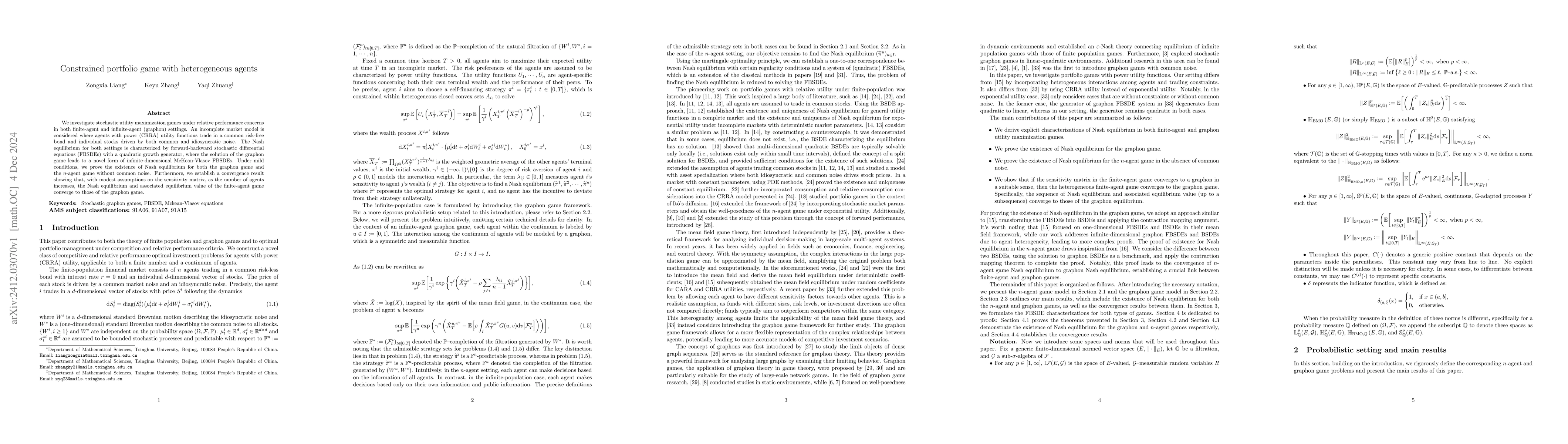

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)