Summary

This paper focuses on the application of quantitative portfolio management by using integer programming and clustering techniques. Investors seek to gain the highest profits and lowest risk in capital markets. A data-oriented analysis of US stock universe is used to provide portfolio managers a device to track different Exchange Traded Funds. As an example, reconstructing of NASDAQ 100 index fund is presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

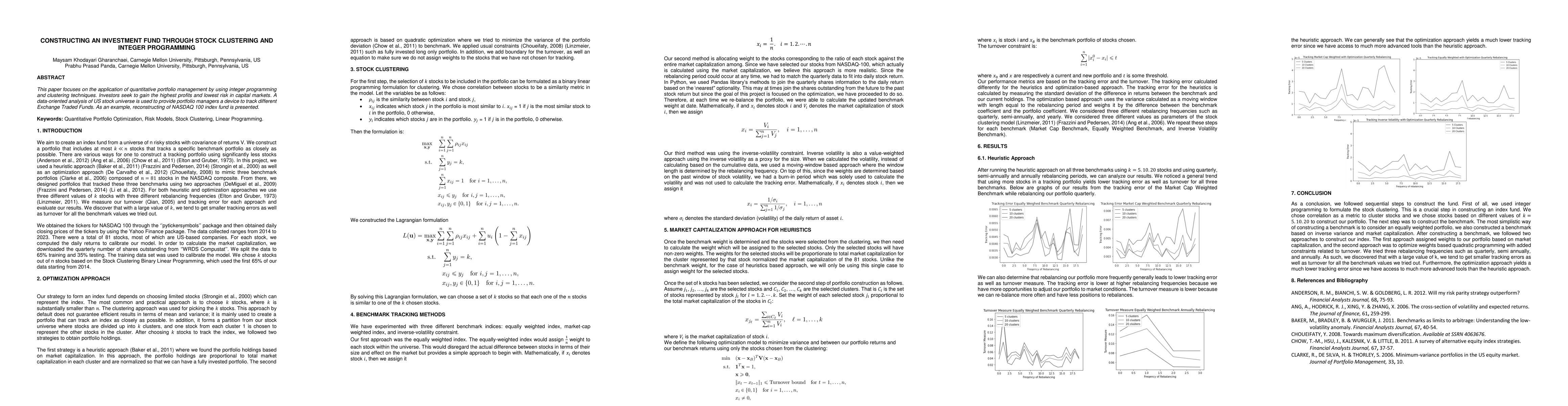

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConstructing extremal triangle-free graphs using integer programming

Tınaz Ekim, Ali Erdem Banak, Z. Caner Taşkın

Constructing Magic Squares: an integer linear programming model and a fast heuristic

João Vitor Pamplona, Maria Eduarda Pinheiro, Luiz-Rafael Santos

An Integer Programming Approach To Subspace Clustering With Missing Data

Akhilesh Soni, Jeff Linderoth, Jim Luedtke et al.

Time Travel is Cheating: Going Live with DeepFund for Real-Time Fund Investment Benchmarking

Chen Wang, Nan Tang, Yuyu Luo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)