Authors

Summary

Capital growth, at large scales only, arrives with no help from net saving, and consequently with no help from consumption constraint. Net saving, at large scales, is sacrifice of consumption with nothing in return.

AI Key Findings

Generated May 28, 2025

Methodology

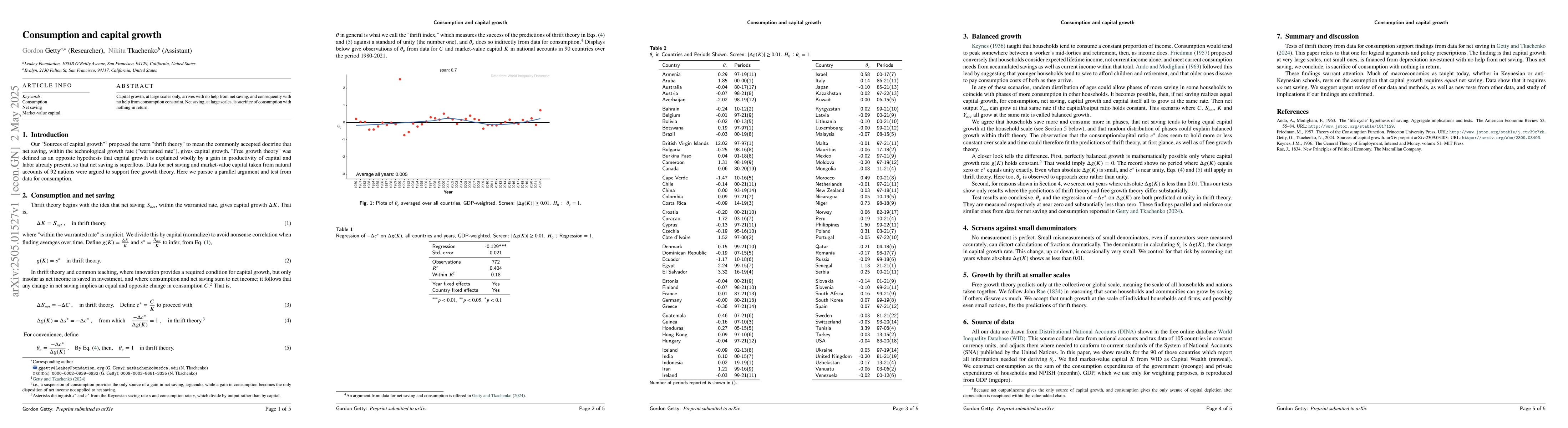

The research analyzes consumption and capital growth using the 'thrift index' (θc) which measures the success of thrift theory predictions in Eqs.(4) and (5) against a standard of unity. Data for consumption (C) and market-value capital (K) from national accounts in 90 countries over the period 1980-2021 are utilized.

Key Results

- Capital growth at large scales occurs without assistance from net saving or consumption constraint.

- Net saving, at large scales, is described as sacrificing consumption with no return.

- Regression of -Δc* on Δg(K) across all countries and years, GDP-weighted, results in a coefficient of -0.129, indicating a significant negative relationship.

- Observation of θc across countries shows that it approaches zero rather than unity, contradicting thrift theory predictions.

- Screening out years with absolute Δg(K) less than 0.01 to control for small denominator risks.

Significance

This research challenges the conventional macroeconomic view that capital growth requires equal net saving, suggesting instead that it can occur without net saving, potentially impacting policies related to savings and consumption.

Technical Contribution

The paper introduces the 'thrift index' (θc) as a tool for evaluating thrift theory predictions against empirical data on consumption and capital growth.

Novelty

The research presents evidence contradicting the widespread assumption that capital growth requires equal net saving, proposing instead that it can occur without net saving, supported by data from 90 countries over 40 years.

Limitations

- Data quality and potential measurement errors, especially concerning small denominators like changes in capital growth rate (Δg(K))

- The study's findings are based on large-scale capital growth, which may not directly apply to smaller scales

Future Work

- Further investigation into the applicability of findings at smaller scales and across different economic contexts

- Exploration of additional datasets and methodologies to corroborate or refute the current findings

Paper Details

PDF Preview

Similar Papers

Found 4 papersForeign Capital and Economic Growth: Evidence from Bangladesh

Ummya Salma, Md. Fazlul Huq Khan, Md. Masum Billah

No citations found for this paper.

Comments (0)