Authors

Summary

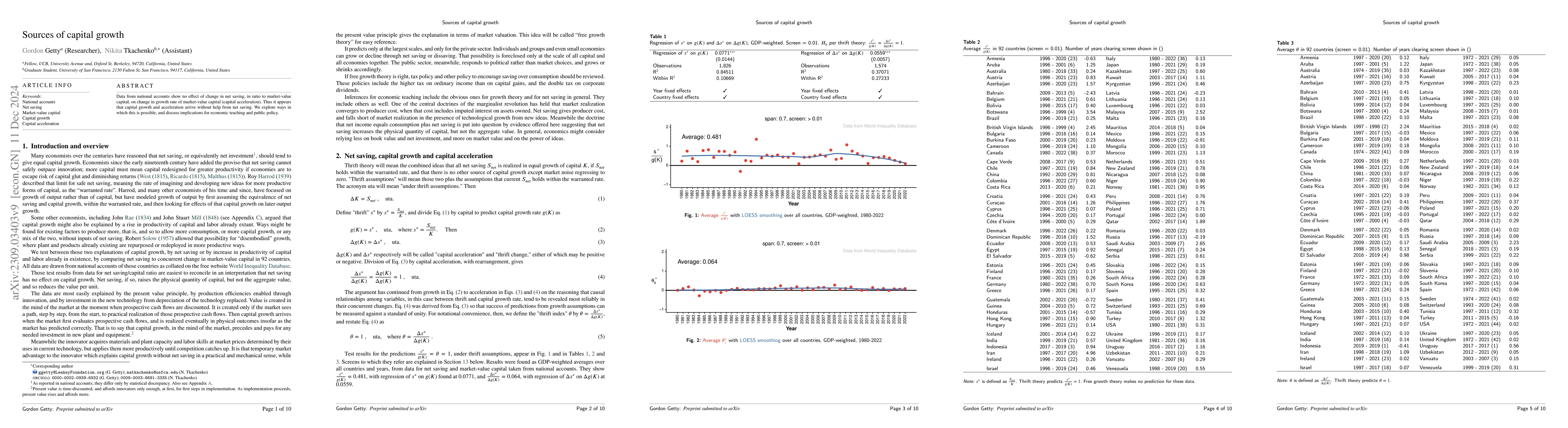

Data from national accounts show no effect of change in net saving or consumption, in ratio to market-value capital, on change in growth rate of market-value capital (capital acceleration). Thus it appears that capital growth and acceleration arrive without help from net saving or consumption restraint. We explore ways in which this is possible, and discuss implications for economic teaching and public policy

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)