Summary

We consider an optimal control problem for a linear stochastic integro-diffe\-rential equation with conic constraints on the phase variable and the control of singular-regular type. Our setting includes consumption-investment problems for models of financial markets in the presence of proportional transaction costs where the price of the assets are given by a geometric L\'evy process and the investor is allowed to take short positions. We prove that the Bellman function of the problem is a viscosity solution of the HJB equation. A uniqueness theorem for the solution of the latter is established. Special attention is paid to the Dynamic Programming Principle.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

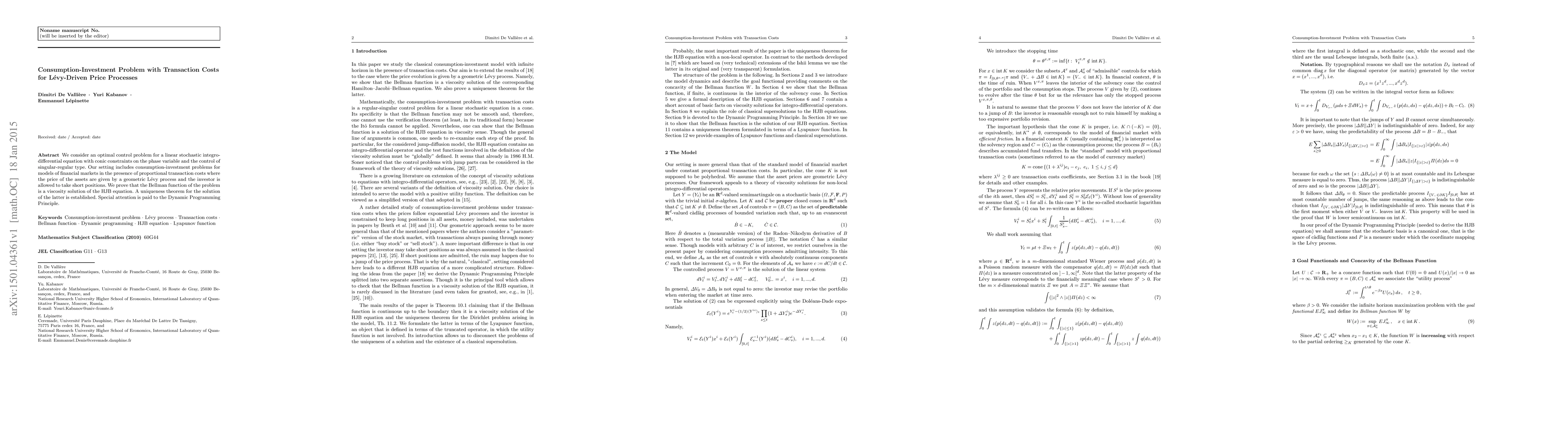

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)