Summary

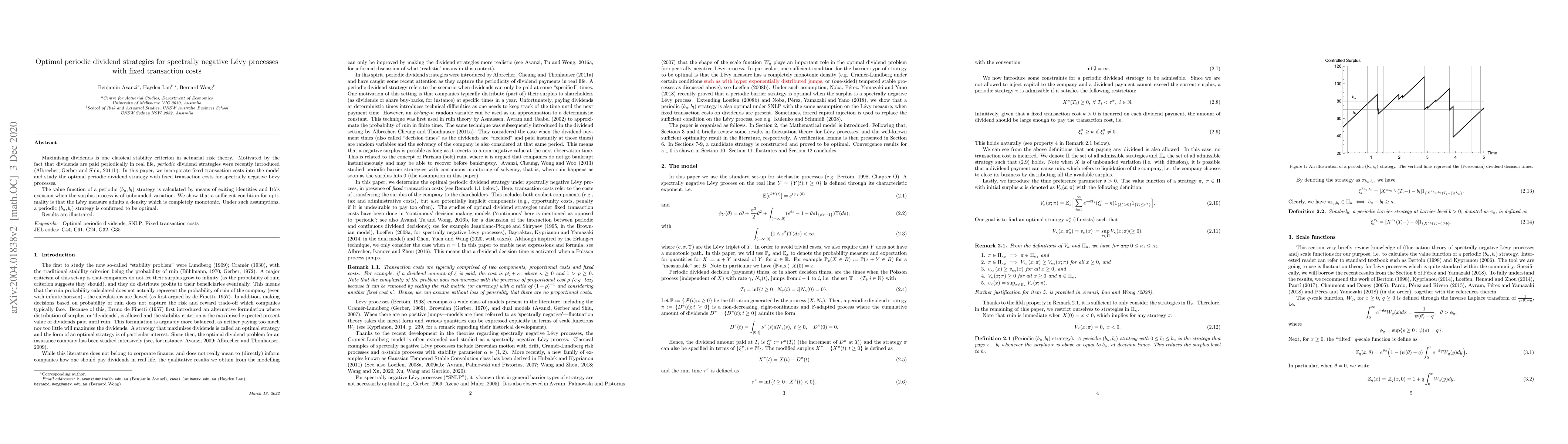

Maximising dividends is one classical stability criterion in actuarial risk theory. Motivated by the fact that dividends are paid periodically in real life, $\textit{periodic}$ dividend strategies were recently introduced (Albrecher, Gerber and Shiu, 2011). In this paper, we incorporate fixed transaction costs into the model and study the optimal periodic dividend strategy with fixed transaction costs for spectrally negative L\'evy processes. The value function of a periodic $(b_u,b_l)$ strategy is calculated by means of exiting identities and It\^o's excusion when the surplus process is of unbounded variation. We show that a sufficient condition for optimality is that the L\'evy measure admits a density which is completely monotonic. Under such assumptions, a periodic $(b_u,b_l)$ strategy is confirmed to be optimal. Results are illustrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)