Summary

We consider the general class of spectrally positive L\'evy risk processes, which are appropriate for businesses with continuous expenses and lump sum gains whose timing and sizes are stochastic. Motivated by the fact that dividends cannot be paid at any time in real life, we study $\textit{periodic}$ dividend strategies whereby dividend decisions are made according to a separate arrival process. In this paper, we investigate the impact of fixed transaction costs on the optimal periodic dividend strategy, and show that a periodic $(b_u,b_l)$ strategy is optimal when decision times arrive according to an independent Poisson process. Such a strategy leads to lump sum dividends that bring the surplus back to $b_l$ as long as it is no less than $b_u$ at a dividend decision time. The expected present value of dividends (net of transaction costs) is provided explicitly with the help of scale functions. Results are illustrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

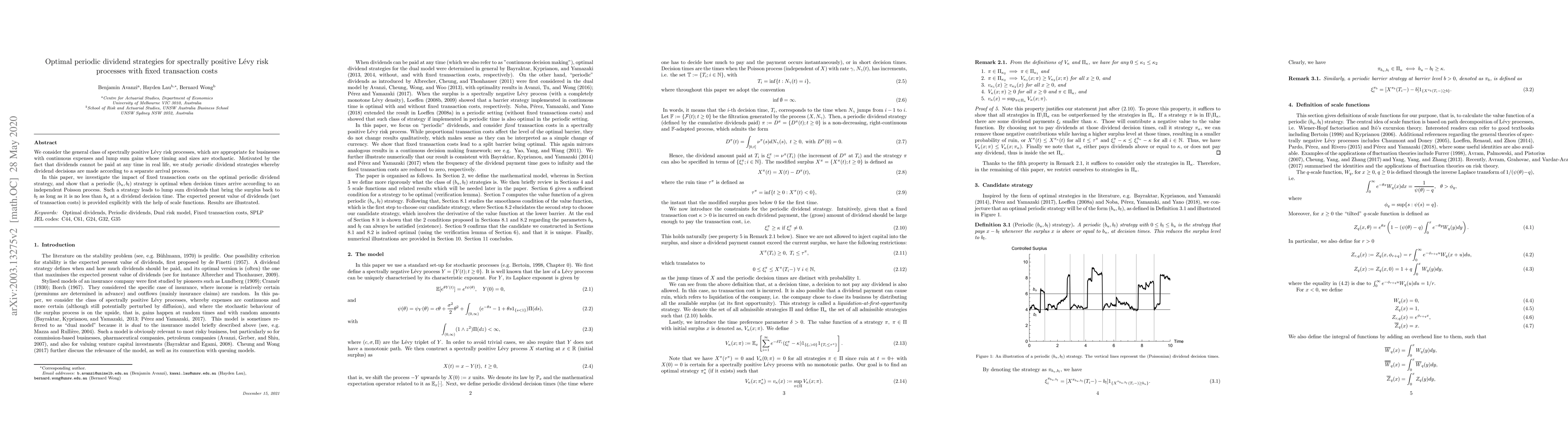

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the Bailout Dividend Problem with Periodic Dividend Payments and Fixed Transaction Costs

Harold A. Moreno-Franco, Jose-Luis Pérez

| Title | Authors | Year | Actions |

|---|

Comments (0)