Summary

The expected present value of dividends is one of the classical stability criteria in actuarial risk theory. In this context, numerous papers considered threshold (refractive) and barrier (reflective) dividend strategies. These were shown to be optimal in a number of different contexts for bounded and unbounded payout rates, respectively. In this paper, motivated by the behaviour of some dividend paying stock exchange companies, we determine the optimal dividend strategy when both continuous (refractive) and lump sum (reflective) dividends can be paid at any time, and if they are subject to different transaction rates. We consider the general family of spectrally positive L\'evy processes. Using scale functions, we obtain explicit formulas for the expected present value of dividends until ruin, with a penalty at ruin. We develop a verification lemma, and show that a two-layer (a,b) strategy is optimal. Such a strategy pays continuous dividends when the surplus exceeds level a>0, and all of the excess over b>a as lump sum dividend payments. Results are illustrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

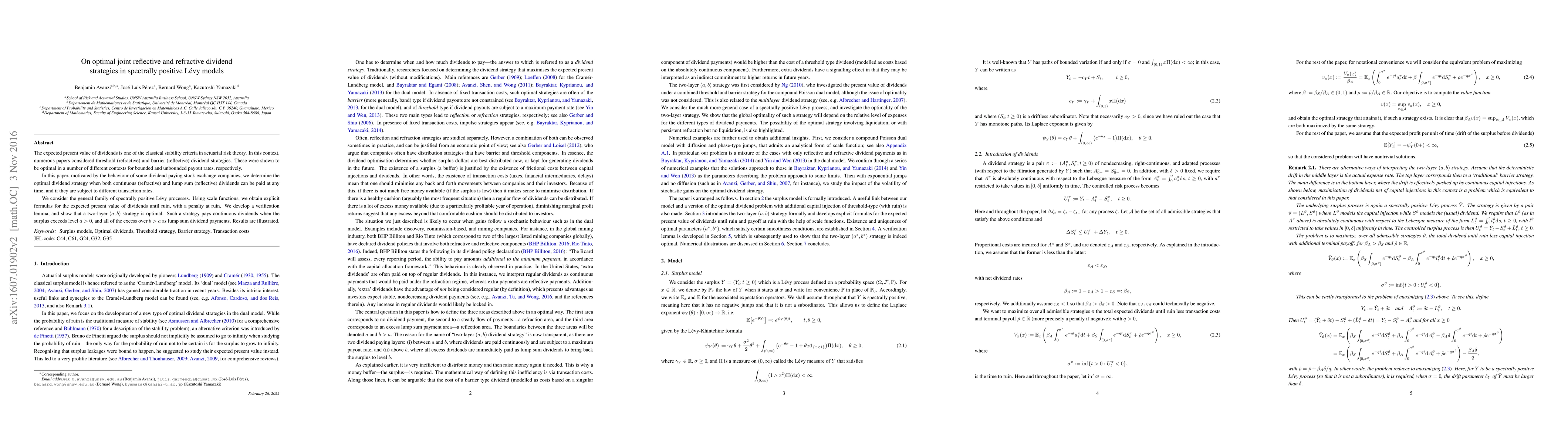

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)