Authors

Summary

We introduce a heterogeneous formulation of a contagious McKean-Vlasov system, whose inherent heterogeneity comes from asymmetric interactions with a natural and highly tractable structure. It is shown that this formulation characterises the limit points of a finite particle system, deriving from a balance sheet based model of solvency contagion in interbank markets, where banks have heterogeneous exposure to and impact on the distress within the system. We also provide a simple result on global uniqueness for the full problem with common noise under a smallness condition on the strength of interactions, and we show that, in the problem without common noise, there is a unique differentiable solution up to an explosion time. Finally, we discuss an intuitive and consistent way of specifying how the system should jump to resolve an instability when the contagious pressures become too large. This is known to happen even in the homogeneous version of the problem, where jumps are specified by a 'physical' notion of solution, but no such notion currently exists for a heterogeneous formulation of the system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

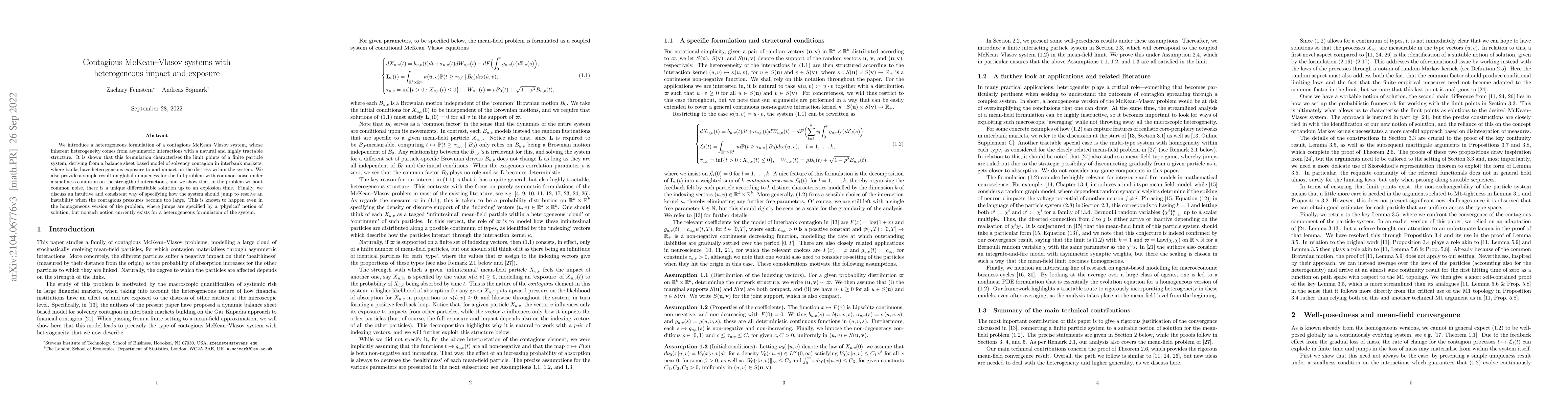

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContagious McKean--Vlasov problems with common noise: from smooth to singular feedback through hitting times

Ben Hambly, Christoph Reisinger, Andreas Søjmark et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)