Authors

Summary

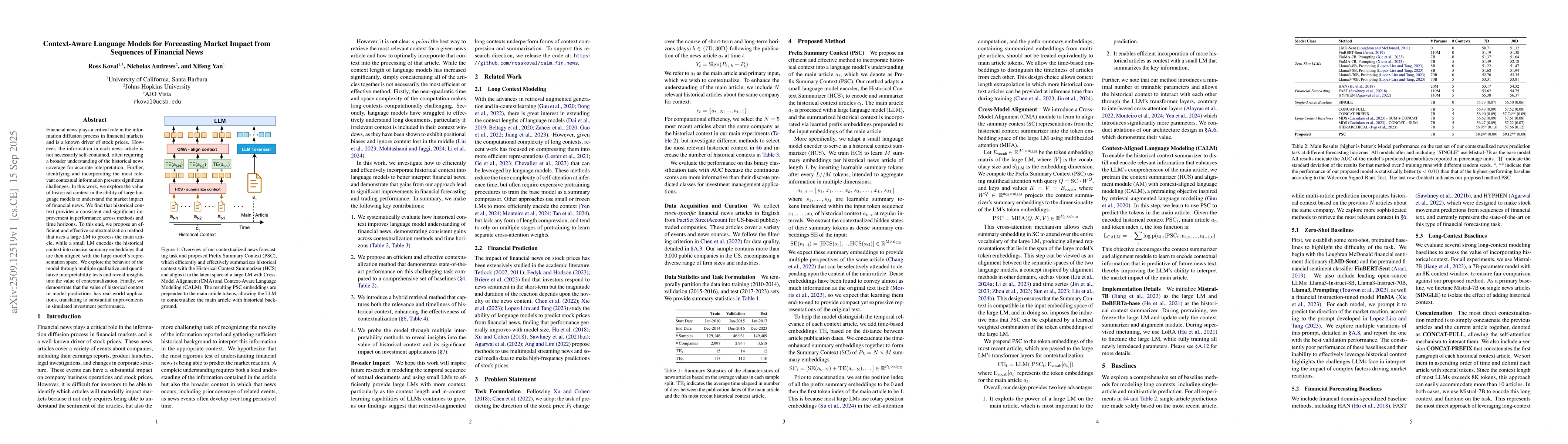

Financial news plays a critical role in the information diffusion process in financial markets and is a known driver of stock prices. However, the information in each news article is not necessarily self-contained, often requiring a broader understanding of the historical news coverage for accurate interpretation. Further, identifying and incorporating the most relevant contextual information presents significant challenges. In this work, we explore the value of historical context in the ability of large language models to understand the market impact of financial news. We find that historical context provides a consistent and significant improvement in performance across methods and time horizons. To this end, we propose an efficient and effective contextualization method that uses a large LM to process the main article, while a small LM encodes the historical context into concise summary embeddings that are then aligned with the large model's representation space. We explore the behavior of the model through multiple qualitative and quantitative interpretability tests and reveal insights into the value of contextualization. Finally, we demonstrate that the value of historical context in model predictions has real-world applications, translating to substantial improvements in simulated investment performance.

AI Key Findings

Generated Oct 02, 2025

Methodology

The research employs a hybrid retrieval method combining Time-based and content-based approaches to select historical news articles. It uses portfolio simulations and Fama-French 6-Factor models to evaluate the economic impact of model predictions on stock returns.

Key Results

- The proposed hybrid retrieval method outperformed existing methods with a 30-day AUC of 59.12%

- Portfolio simulations showed significant returns from model predictions, with conservative transaction cost estimates included

- The alignment module with cross-attention mechanisms showed improved convergence for parameter-efficient fine-tuning

Significance

This research provides a robust framework for integrating historical news context with financial predictions, offering practical applications in market-neutral portfolio strategies and enhancing the accuracy of sentiment analysis for stock price forecasting.

Technical Contribution

Development of a novel hybrid retrieval system for contextual news selection and an improved alignment module with cross-attention mechanisms for better convergence in parameter-efficient fine-tuning.

Novelty

Combines content-based and time-based retrieval methods for news article selection, along with a specialized alignment module that enhances the effectiveness of parameter-efficient fine-tuning for financial prediction tasks.

Limitations

- Relies on human-curated news data which may limit the scope of available articles

- Conservative transaction cost estimates may underrepresent actual implementation costs

Future Work

- Exploring more sophisticated parameter-efficient fine-tuning techniques

- Investigating the impact of real-time news integration with market data

- Expanding the framework to include additional financial factors and market indicators

Paper Details

PDF Preview

Similar Papers

Found 4 papersMultimodal Language Models with Modality-Specific Experts for Financial Forecasting from Interleaved Sequences of Text and Time Series

Xifeng Yan, Nicholas Andrews, Ross Koval

Modeling News Interactions and Influence for Financial Market Prediction

Mengyu Wang, Shay B. Cohen, Tiejun Ma

Cross-Modal Temporal Fusion for Financial Market Forecasting

John Cartlidge, Yunhua Pei, Daniel Gold et al.

News-Aware Direct Reinforcement Trading for Financial Markets

Yun-Song Piao, Yu-Tong Wang, Jun-Qian Jiang et al.

Comments (0)