Summary

We consider the class of affine LIBOR models with multiple curves, which is an analytically tractable class of discrete tenor models that easily accommodates positive or negative interest rates and positive spreads. By introducing an interpolating function, we extend the affine LIBOR models to a continuous tenor and derive expressions for the instantaneous forward rate and the short rate. We show that the continuous tenor model is arbitrage-free, that the analytical tractability is retained under the spot martingale measure, and that under mild conditions an interpolating function can be found such that the extended model fits any initial forward curve. This allows us to compute value adjustments (i.e. XVAs) consistently, by solving the corresponding `pre-default' BSDE. As an application, we compute the price and value adjustments for a basis swap, and study the model risk associated to different interpolating functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

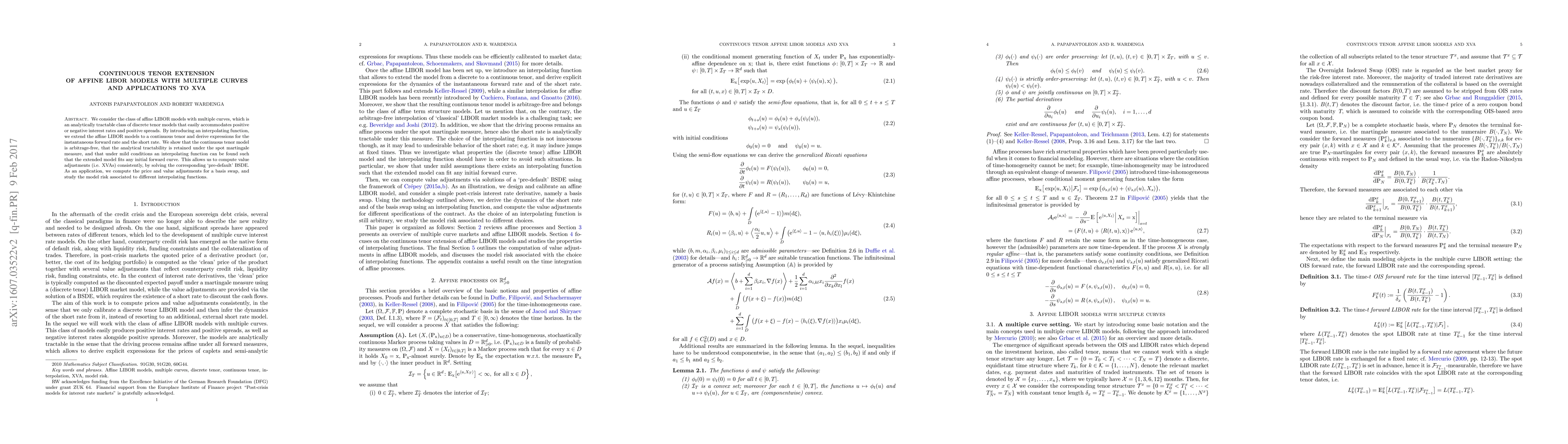

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)