Summary

We provide a general and flexible approach to LIBOR modeling based on the class of affine factor processes. Our approach respects the basic economic requirement that LIBOR rates are non-negative, and the basic requirement from mathematical finance that LIBOR rates are analytically tractable martingales with respect to their own forward measure. Additionally, and most importantly, our approach also leads to analytically tractable expressions of multi-LIBOR payoffs. This approach unifies therefore the advantages of well-known forward price models with those of classical LIBOR rate models. Several examples are added and prototypical volatility smiles are shown. We believe that the CIR-process based LIBOR model might be of particular interest for applications, since closed form valuation formulas for caps and swaptions are derived.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

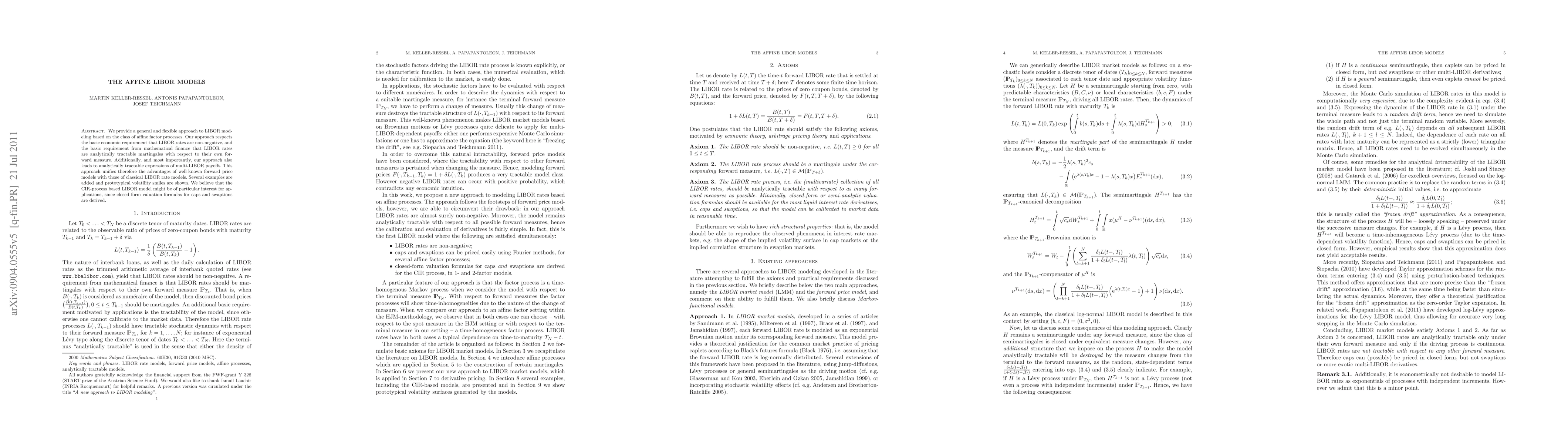

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)