Authors

Summary

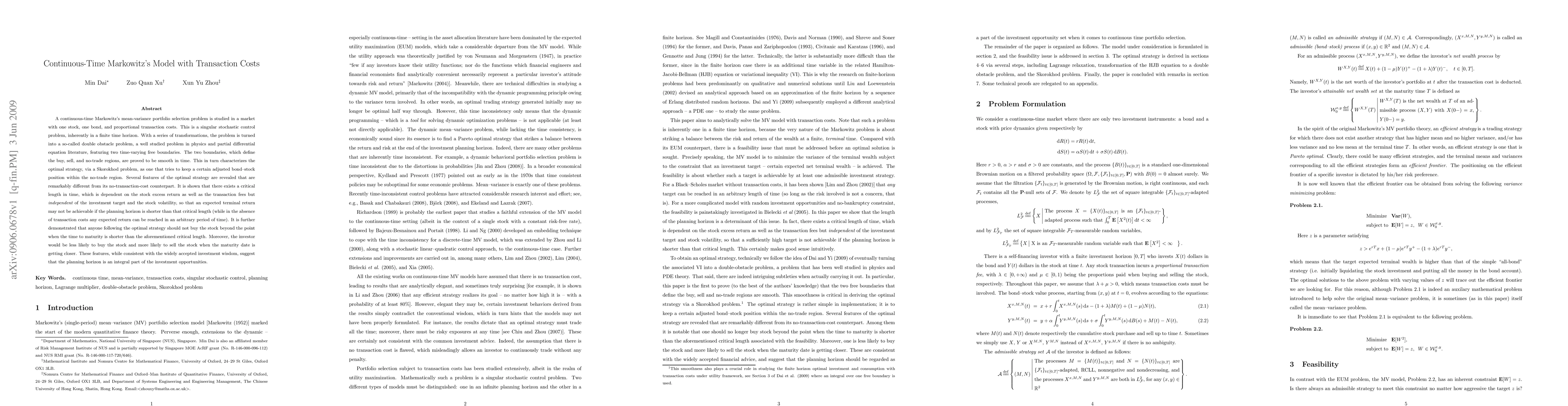

A continuous-time Markowitz's mean-variance portfolio selection problem is studied in a market with one stock, one bond, and proportional transaction costs. This is a singular stochastic control problem,inherently in a finite time horizon. With a series of transformations, the problem is turned into a so-called double obstacle problem, a well studied problem in physics and partial differential equation literature, featuring two time-varying free boundaries. The two boundaries, which define the buy, sell, and no-trade regions, are proved to be smooth in time. This in turn characterizes the optimal strategy, via a Skorokhod problem, as one that tries to keep a certain adjusted bond-stock position within the no-trade region. Several features of the optimal strategy are revealed that are remarkably different from its no-transaction-cost counterpart. It is shown that there exists a critical length in time, which is dependent on the stock excess return as well as the transaction fees but independent of the investment target and the stock volatility, so that an expected terminal return may not be achievable if the planning horizon is shorter than that critical length (while in the absence of transaction costs any expected return can be reached in an arbitrary period of time). It is further demonstrated that anyone following the optimal strategy should not buy the stock beyond the point when the time to maturity is shorter than the aforementioned critical length. Moreover, the investor would be less likely to buy the stock and more likely to sell the stock when the maturity date is getting closer. These features, while consistent with the widely accepted investment wisdom, suggest that the planning horizon is an integral part of the investment opportunities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContinuous-time Markowitz's mean-variance model under different borrowing and saving rates

Xiaomin Shi, Zuo Quan Xu, Chonghu Guan

Continuous-time Equilibrium Returns in Markets with Price Impact and Transaction Costs

Michail Anthropelos, Constantinos Stefanakis

| Title | Authors | Year | Actions |

|---|

Comments (0)