Authors

Summary

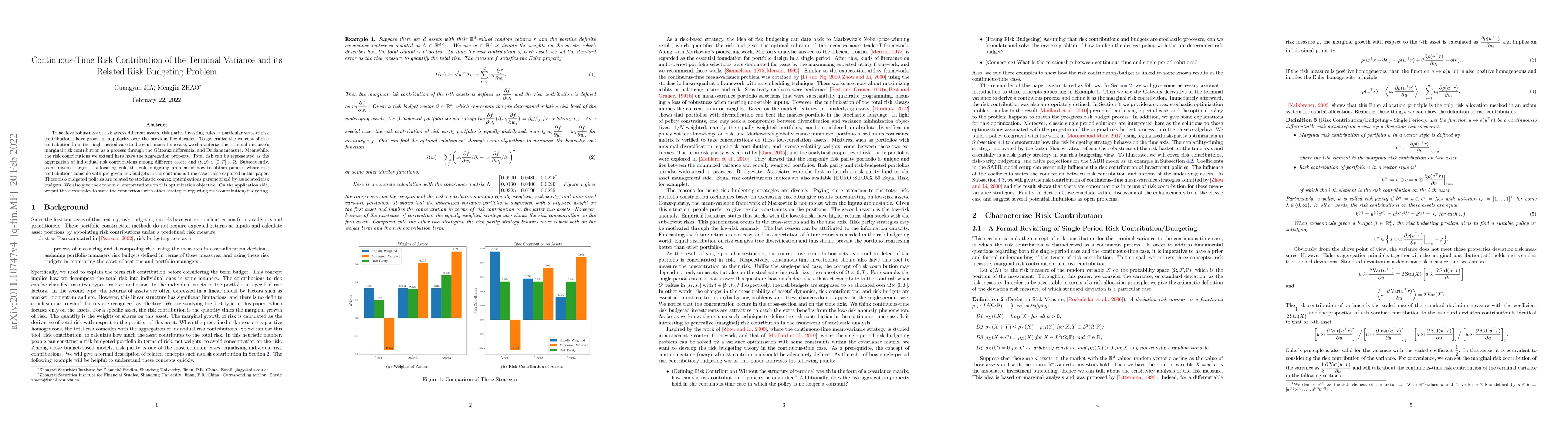

To achieve robustness of risk across different assets, risk parity investing rules, a particular state of risk contributions, have grown in popularity over the previous few decades. To generalize the concept of risk contribution from the simple covariance matrix case to the continuous-time case in which the terminal variance of wealth is used as the risk measure, we characterize risk contributions and marginal risk contributions on various assets as predictable processes using the Gateaux differential and Doleans measure. Meanwhile, the risk contributions we extend here have the aggregation property, namely that total risk can be represented as the aggregation of those among different assets and $(t,\omega)$. Subsequently, as an inverse target -- allocating risk, the risk budgeting problem of how to obtain policies whose risk contributions coincide with pre-given risk budgets in the continuous-time case is also explored in this paper. These policies are solutions to stochastic convex optimizations parametrized by the pre-given risk budgets. Moreover, single-period risk budgeting policies are explained as the projection of risk budgeting policies in continuous-time cases. On the application side, volatility-managed portfolios in [Moreira and Muir,2017] can be obtained by risk budgeting optimization; similarly to previous findings, continuous-time mean-variance allocation in [Zhou and Li, 2000] appears to be concentrated in terms of risk contribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk Budgeting Portfolios: Existence and Computation

Olivier Guéant, Adil Rengim Cetingoz, Jean-David Fermanian

Risk Budgeting Allocation for Dynamic Risk Measures

Sebastian Jaimungal, Silvana M. Pesenti, Yuri F. Saporito et al.

Asset and Factor Risk Budgeting: A Balanced Approach

Olivier Guéant, Adil Rengim Cetingoz

| Title | Authors | Year | Actions |

|---|

Comments (0)