Summary

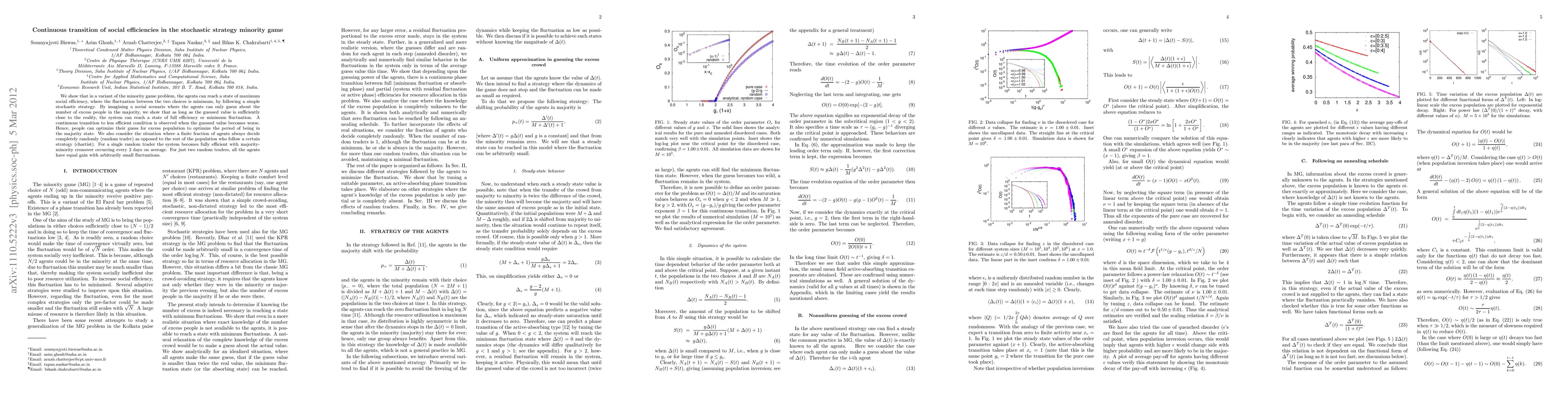

We show that in a variant of the Minority Game problem, the agents can reach a state of maximum social efficiency, where the fluctuation between the two choices is minimum, by following a simple stochastic strategy. By imagining a social scenario where the agents can only guess about the number of excess people in the majority, we show that as long as the guess value is sufficiently close to the reality, the system can reach a state of full efficiency or minimum fluctuation. A continuous transition to less efficient condition is observed when the guess value becomes worse. Hence, people can optimize their guess value for excess population to optimize the period of being in the majority state. We also consider the situation where a finite fraction of agents always decide completely randomly (random trader) as opposed to the rest of the population that follow a certain strategy (chartist). For a single random trader the system becomes fully efficient with majority-minority crossover occurring every two-days interval on average. For just two random traders, all the agents have equal gain with arbitrarily small fluctuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSocial and individual learning in the Minority Game

Bryce Morsky, Fuwei Zhuang, Zuojun Zhou

| Title | Authors | Year | Actions |

|---|

Comments (0)