Summary

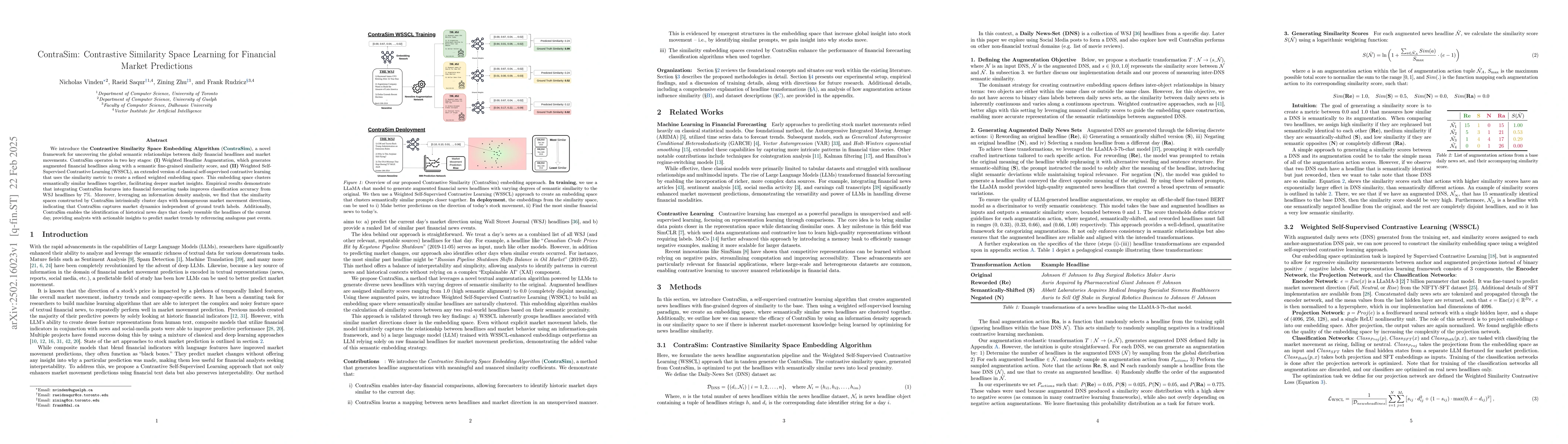

We introduce the Contrastive Similarity Space Embedding Algorithm (ContraSim), a novel framework for uncovering the global semantic relationships between daily financial headlines and market movements. ContraSim operates in two key stages: (I) Weighted Headline Augmentation, which generates augmented financial headlines along with a semantic fine-grained similarity score, and (II) Weighted Self-Supervised Contrastive Learning (WSSCL), an extended version of classical self-supervised contrastive learning that uses the similarity metric to create a refined weighted embedding space. This embedding space clusters semantically similar headlines together, facilitating deeper market insights. Empirical results demonstrate that integrating ContraSim features into financial forecasting tasks improves classification accuracy from WSJ headlines by 7%. Moreover, leveraging an information density analysis, we find that the similarity spaces constructed by ContraSim intrinsically cluster days with homogeneous market movement directions, indicating that ContraSim captures market dynamics independent of ground truth labels. Additionally, ContraSim enables the identification of historical news days that closely resemble the headlines of the current day, providing analysts with actionable insights to predict market trends by referencing analogous past events.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research introduces ContraSim, a framework that uses Weighted Headline Augmentation and Weighted Self-Supervised Contrastive Learning (WSSCL) to uncover global semantic relationships between financial headlines and market movements.

Key Results

- ContraSim improves classification accuracy in financial forecasting tasks by 7% when integrating its features.

- ContraSim constructs similarity spaces that intrinsically cluster days with homogeneous market movement directions, capturing market dynamics independent of ground truth labels.

- ContraSim enables the identification of historical news days that resemble current day headlines, providing actionable insights for predicting market trends.

Significance

This research is significant as it enhances financial forecasting by leveraging semantic relationships in financial headlines, offering analysts actionable insights through clustering and identifying analogous past events.

Technical Contribution

The ContraSim framework, combining Weighted Headline Augmentation and Weighted Self-Supervised Contrastive Learning (WSSCL), creates a refined weighted embedding space for clustering semantically similar headlines.

Novelty

ContraSim's novelty lies in its approach to financial market forecasting by uncovering global semantic relationships between financial headlines and market movements using contrastive similarity learning.

Limitations

- The paper does not provide true baseline values for evaluation metrics on unbalanced sets of labels, using estimated baseline values instead.

- The generalizability of ContraSim across diverse text types and contexts remains to be explored in future work.

Future Work

- Explore application of ContraSim to diverse domains like healthcare, legal, and social media datasets.

- Incorporate advanced LLMs like GPT-4 to enhance embedding quality and clustering performance.

- Investigate integration of techniques such as hard negative mining, dynamic temperature scaling, and multi-task learning with ContraSim.

- Extend ContraSim to real-time financial forecasting applications and unsupervised learning scenarios.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPhenoGnet: A Graph-Based Contrastive Learning Framework for Disease Similarity Prediction

Aaron J. Masino, Ranga Baminiwatte, Kazi Jewel Rana

Convergence-aware Clustered Federated Graph Learning Framework for Collaborative Inter-company Labor Market Forecasting

Qi Zhang, Le Zhang, Hao Liu et al.

No citations found for this paper.

Comments (0)