Summary

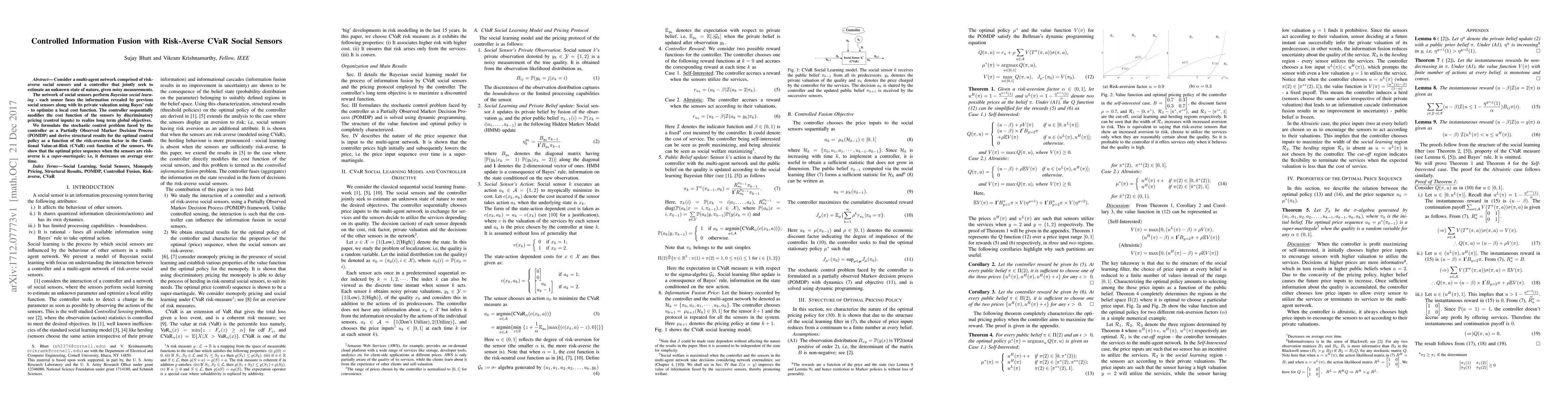

Consider a multi-agent network comprised of risk averse social sensors and a controller that jointly seek to estimate an unknown state of nature, given noisy measurements. The network of social sensors perform Bayesian social learning - each sensor fuses the information revealed by previous social sensors along with its private valuation using Bayes' rule - to optimize a local cost function. The controller sequentially modifies the cost function of the sensors by discriminatory pricing (control inputs) to realize long term global objectives. We formulate the stochastic control problem faced by the controller as a Partially Observed Markov Decision Process (POMDP) and derive structural results for the optimal control policy as a function of the risk-aversion factor in the Conditional Value-at-Risk (CVaR) cost function of the sensors. We show that the optimal price sequence when the sensors are risk- averse is a super-martingale; i.e, it decreases on average over time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRisk-averse learning with delayed feedback

Zifan Wang, Sandra Hirche, Karl Henrik Johansson et al.

Learning of Nash Equilibria in Risk-Averse Games

Zifan Wang, Yi Shen, Michael M. Zavlanos et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)