Authors

Summary

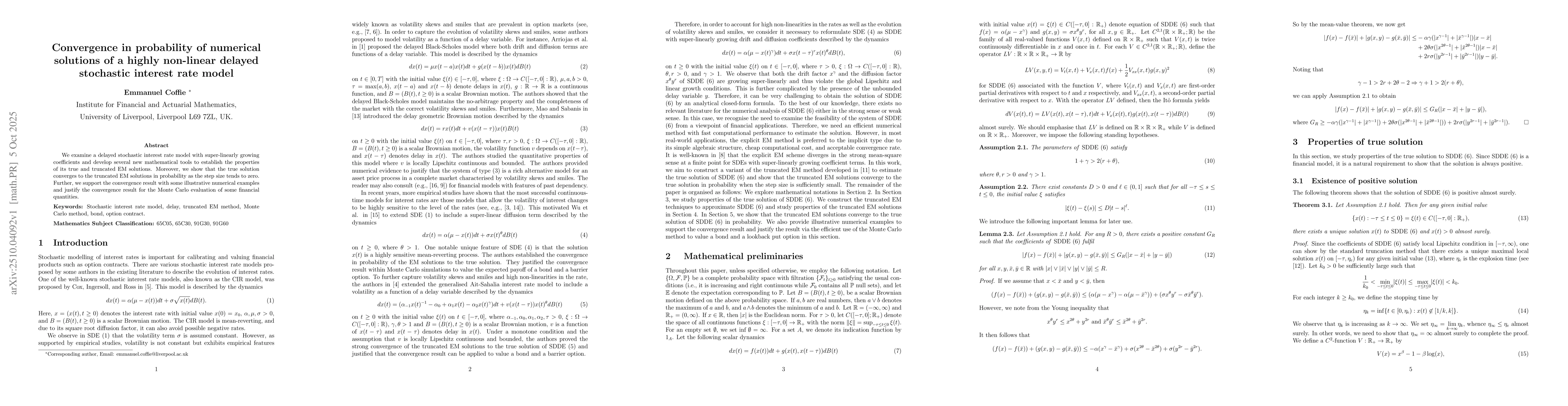

We examine a delayed stochastic interest rate model with super-linearly growing coefficients and develop several new mathematical tools to establish the properties of its true and truncated EM solutions. Moreover, we show that the true solution converges to the truncated EM solutions in probability as the step size tends to zero. Further, we support the convergence result with some illustrative numerical examples and justify the convergence result for the Monte Carlo evaluation of some financial quantities.

AI Key Findings

Generated Oct 11, 2025

Methodology

The paper develops truncated Euler-Maruyama (EM) methods for solving a delayed stochastic interest rate model with super-linearly growing coefficients. It establishes convergence properties using mathematical tools and numerical simulations.

Key Results

- The true solution of the SDDE converges to the truncated EM solutions in probability as the step size tends to zero.

- The truncated EM solutions are shown to be bounded and do not explode in finite time under certain conditions.

- The paper demonstrates that the truncated EM method provides accurate approximations for financial quantities like bond prices and lookback options.

Significance

This research provides a robust numerical framework for solving complex stochastic interest rate models with delays, which is crucial for accurate financial modeling and risk assessment in markets with non-linear dynamics.

Technical Contribution

The paper introduces a truncated EM method for SDDEs with super-linear coefficients and proves its convergence in probability, along with error bounds for finite-time approximations.

Novelty

This work is novel due to its focus on highly non-linear delayed stochastic interest rate models with super-linearly growing coefficients, and the development of new mathematical tools to establish convergence properties for both true and truncated EM solutions.

Limitations

- The analysis assumes specific conditions on the coefficients of the SDDE, which may limit its applicability to other types of models.

- The convergence results rely on the choice of truncated functions and step size, which may require careful tuning in practical implementations.

Future Work

- Extending the methodology to handle more general classes of stochastic delay differential equations.

- Investigating the application of these methods to other financial instruments beyond bonds and lookback options.

- Exploring the use of adaptive step size strategies to improve computational efficiency.

Paper Details

PDF Preview

Similar Papers

Found 4 papersConvergence of a splitting method for a general interest rate model

Gabriel Lord Mengchao Wang

Comments (0)