Summary

In this paper, we study analytical properties of the solutions to the generalised delay Ait-Sahalia-type interest rate model with Poisson-driven jump. Since this model does not have explicit solution, we employ several new truncated Euler-Maruyama (EM) techniques to investigate finite time strong convergence theory of the numerical solutions under the local Lipschitz condition plus the Khasminskii-type condition. We justify the strong convergence result for Monte Carlo calibration and valuation of some debt and derivative instruments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

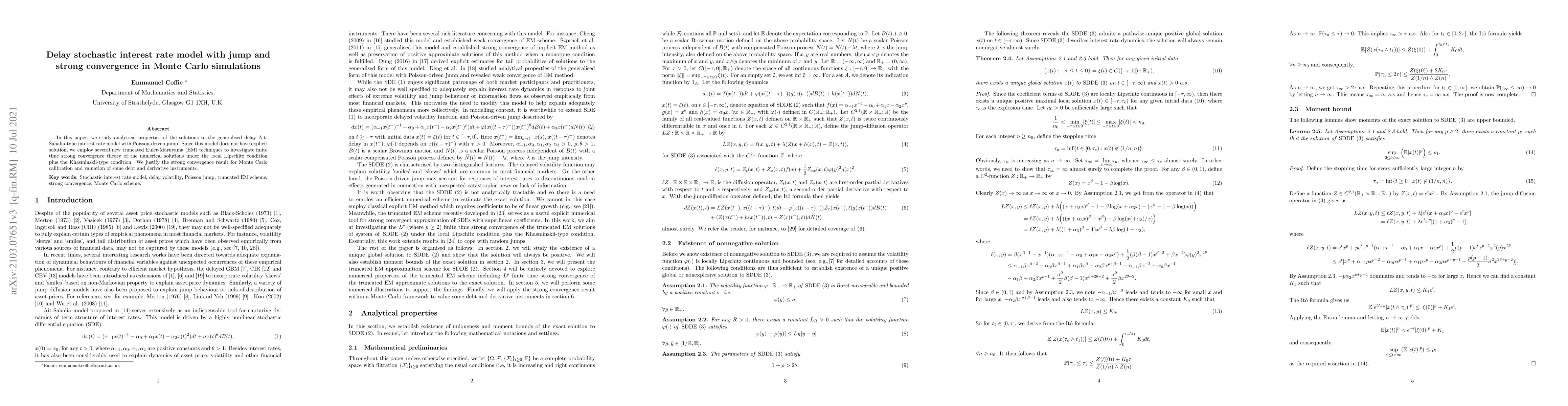

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvergence in probability of numerical solutions of a highly non-linear delayed stochastic interest rate model

Emmanuel Coffie

Monte Carlo versus multilevel Monte Carlo in weak error simulations of SPDE approximations

Annika Lang, Andreas Petersson

| Title | Authors | Year | Actions |

|---|

Comments (0)