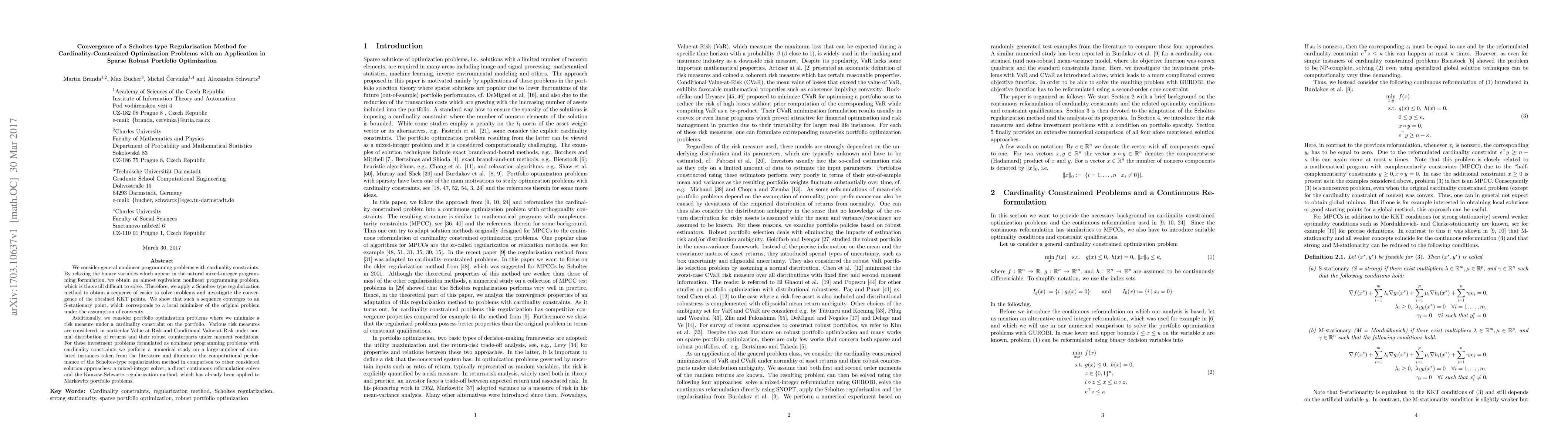

Summary

We consider general nonlinear programming problems with cardinality constraints. By relaxing the binary variables which appear in the natural mixed-integer programming formulation, we obtain an almost equivalent nonlinear programming problem, which is thus still difficult to solve. Therefore, we apply a Scholtes-type regularization method to obtain a sequence of easier to solve problems and investigate the convergence of the obtained KKT points. We show that such a sequence converges to an S-stationary point, which corresponds to a local minimizer of the original problem under the assumption of convexity. Additionally, we consider portfolio optimization problems where we minimize a risk measure under a cardinality constraint on the portfolio. Various risk measures are considered, in particular Value-at-Risk and Conditional Value-at-Risk under normal distribution of returns and their robust counterparts under moment conditions. For these investment problems formulated as nonlinear programming problems with cardinality constraints we perform a numerical study on a large number of simulated instances taken from the literature and illuminate the computational performance of the Scholtes-type regularization method in comparison to other considered solution approaches: a mixed-integer solver, a direct continuous reformulation solver and the Kanzow-Schwartz regularization method, which has already been applied to Markowitz portfolio problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtended convergence analysis of the Scholtes-type regularization for cardinality-constrained optimization problems

Vladimir Shikhman, Sebastian Lammel

Cardinality-constrained Distributionally Robust Portfolio Optimization

Yuichi Takano, Ken Kobayashi, Kazuhide Nakata

| Title | Authors | Year | Actions |

|---|

Comments (0)