Summary

Many stochastic differential equations that occur in financial modelling do not satisfy the standard assumptions made in convergence proofs of numerical schemes that are given in textbooks, i.e., their coefficients and the corresponding derivatives appearing in the proofs are not uniformly bounded and hence, in particular, not globally Lipschitz. Specific examples are the Heston and Cox-Ingersoll-Ross models with square root coefficients and the Ait-Sahalia model with rational coefficient functions. Simple examples show that, for example, the Euler-Maruyama scheme may not converge either in the strong or weak sense when the standard assumptions do not hold. Nevertheless, new convergence results have been obtained recently for many such models in financial mathematics. These are reviewed here. Although weak convergence is of traditional importance in financial mathematics with its emphasis on expectations of functionals of the solutions, strong convergence plays a crucial role in Multi Level Monte Carlo methods, so it and also pathwise convergence will be considered along with methods which preserve the positivity of the solutions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

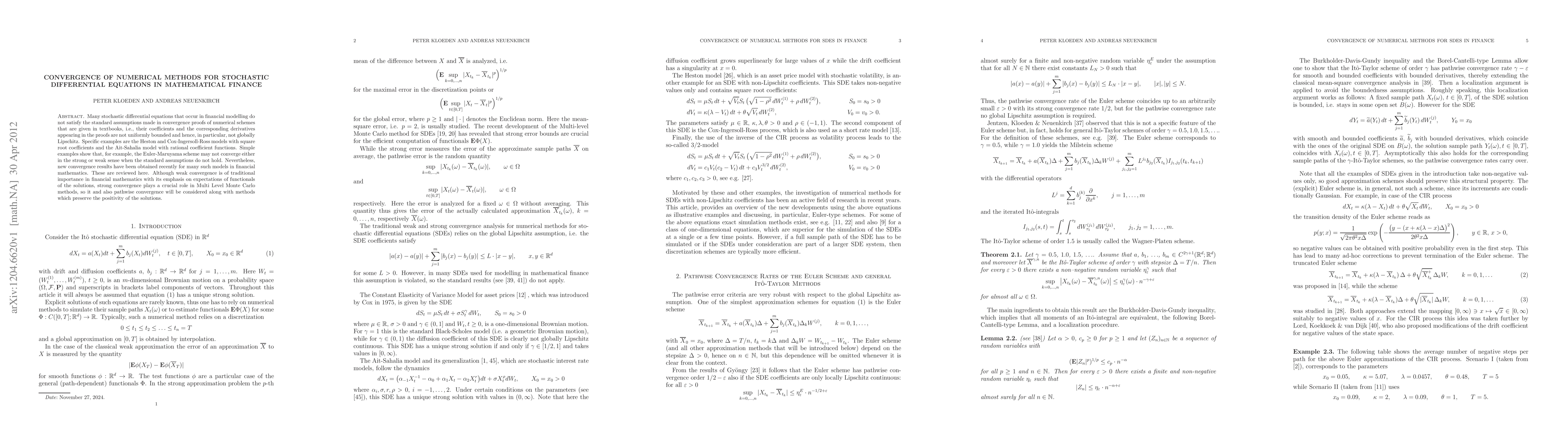

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStrong convergence in the infinite horizon of numerical methods for stochastic differential equations

Yudong Wang, Wei Liu

Strong convergence in the infinite horizon of numerical methods for stochastic delay differential equations

Yudong Wang, Hongjiong Tian

| Title | Authors | Year | Actions |

|---|

Comments (0)