Summary

This paper investigates the large-time asymptotic behavior of the sensitivities of cash flows. In quantitative finance, the price of a cash flow is expressed in terms of a pricing operator of a Markov diffusion process. We study the extent to which the pricing operator is affected by small changes of the underlying Markov diffusion. The main idea is a partial differential equation (PDE) representation of the pricing operator by incorporating the Hansen--Scheinkman decomposition method. The sensitivities of the cash flows and their large-time convergence rates can be represented via simple expressions in terms of eigenvalues and eigenfunctions of the pricing operator. Furthermore, compared to the work of Park (Finance Stoch. 4:773-825, 2018), more detailed convergence rates are provided. In addition, we discuss the application of our results to three practical problems: utility maximization, entropic risk measures, and bond prices. Finally, as examples, explicit results for several market models such as the Cox--Ingersoll--Ross (CIR) model, 3/2 model and constant elasticity of variance (CEV) model are presented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

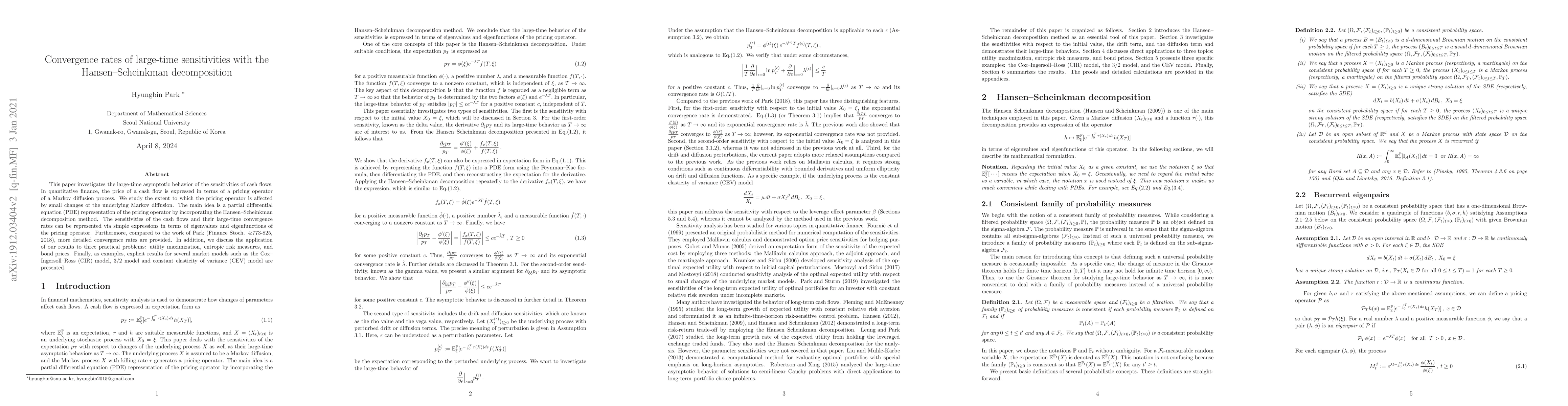

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)