Summary

This paper develops a spectral theory of Markovian asset pricing models where the underlying economic uncertainty follows a continuous-time Markov process X with a general state space (Borel right process (BRP)) and the stochastic discount factor (SDF) is a positive semimartingale multiplicative functional of X. A key result is the uniqueness theorem for a positive eigenfunction of the pricing operator such that X is recurrent under a new probability measure associated with this eigenfunction (recurrent eigenfunction). As economic applications, we prove uniqueness of the Hansen and Scheinkman (2009) factorization of the Markovian SDF corresponding to the recurrent eigenfunction, extend the Recovery Theorem of Ross (2015) from discrete time, finite state irreducible Markov chains to recurrent BRPs, and obtain the long maturity asymptotics of the pricing operator. When an asset pricing model is specified by given risk-neutral probabilities together with a short rate function of the Markovian state, we give sufficient conditions for existence of a recurrent eigenfunction and provide explicit examples in a number of important financial models, including affine and quadratic diffusion models and an affine model with jumps. These examples show that the recurrence assumption, in addition to fixing uniqueness, rules out unstable economic dynamics, such as the short rate asymptotically going to infinity or to a zero lower bound trap without possibility of escaping.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

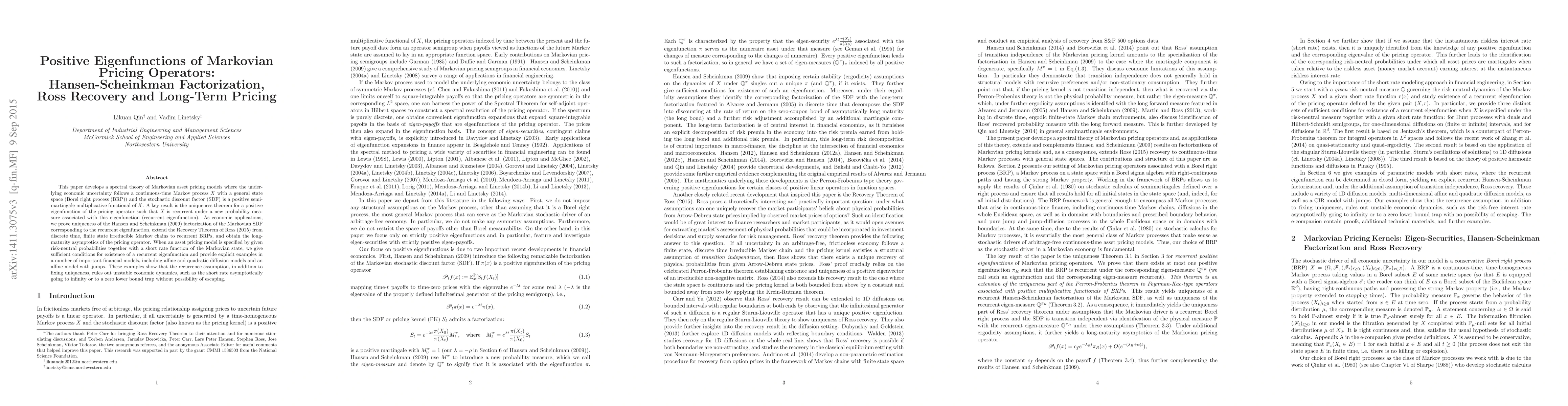

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)