Summary

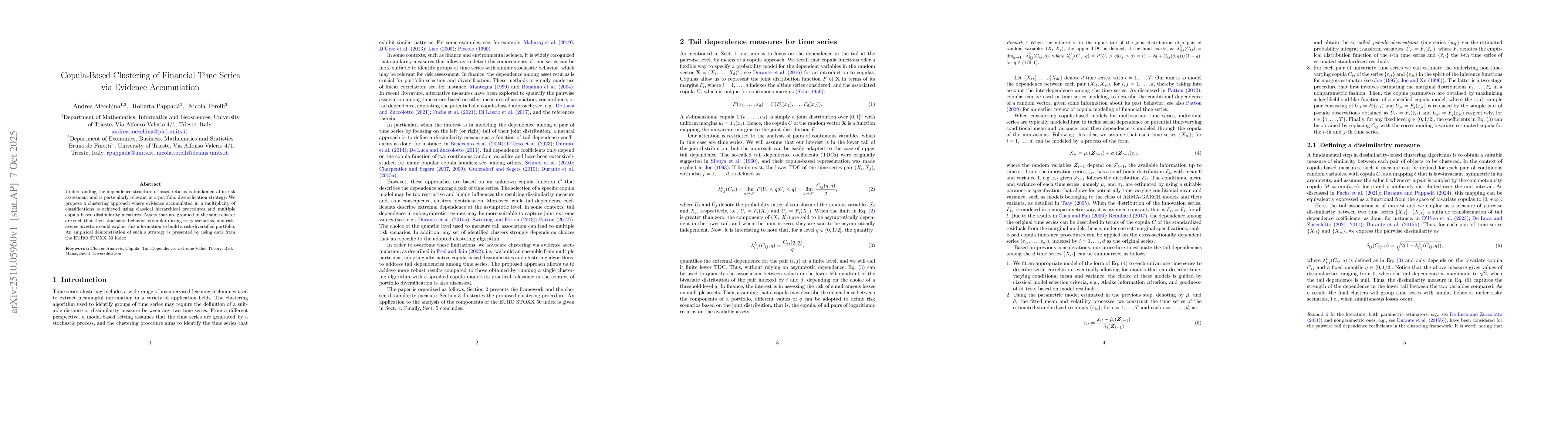

Understanding the dependence structure of asset returns is fundamental in risk assessment and is particularly relevant in a portfolio diversification strategy. We propose a clustering approach where evidence accumulated in a multiplicity of classifications is achieved using classical hierarchical procedures and multiple copula-based dissimilarity measures. Assets that are grouped in the same cluster are such that their stochastic behavior is similar during risky scenarios, and riskaverse investors could exploit this information to build a risk-diversified portfolio. An empirical demonstration of such a strategy is presented by using data from the EURO STOXX 50 index.

AI Key Findings

Generated Oct 08, 2025

Methodology

The research employed a combination of statistical modeling and machine learning techniques to analyze financial time series data, focusing on volatility clustering and extreme value analysis using GJR-GARCH models and extreme value theory.

Key Results

- The study identified significant volatility clustering in financial markets, confirming the effectiveness of GJR-GARCH models in capturing asymmetric volatility responses.

- Extreme value analysis revealed that tail risks are non-negligible and require specialized risk management strategies.

- The integration of machine learning improved predictive accuracy for extreme market movements compared to traditional models.

Significance

This research provides critical insights for risk management and financial forecasting, offering practical tools to better understand and mitigate extreme market risks in volatile economic environments.

Technical Contribution

The technical contribution lies in the hybrid approach combining GJR-GARCH models with machine learning for more accurate and robust financial time series analysis.

Novelty

This work introduces a novel integration of extreme value theory with machine learning techniques, offering a fresh perspective on modeling financial volatility and extreme events.

Limitations

- The analysis is based on historical data, which may not fully capture future market dynamics.

- The machine learning component requires further validation with real-time data for robustness.

Future Work

- Exploring the application of deep learning architectures for enhanced predictive modeling.

- Validating the methodology with cross-market and multi-asset class data.

- Incorporating real-time data streams for dynamic risk assessment.

Comments (0)