Authors

Summary

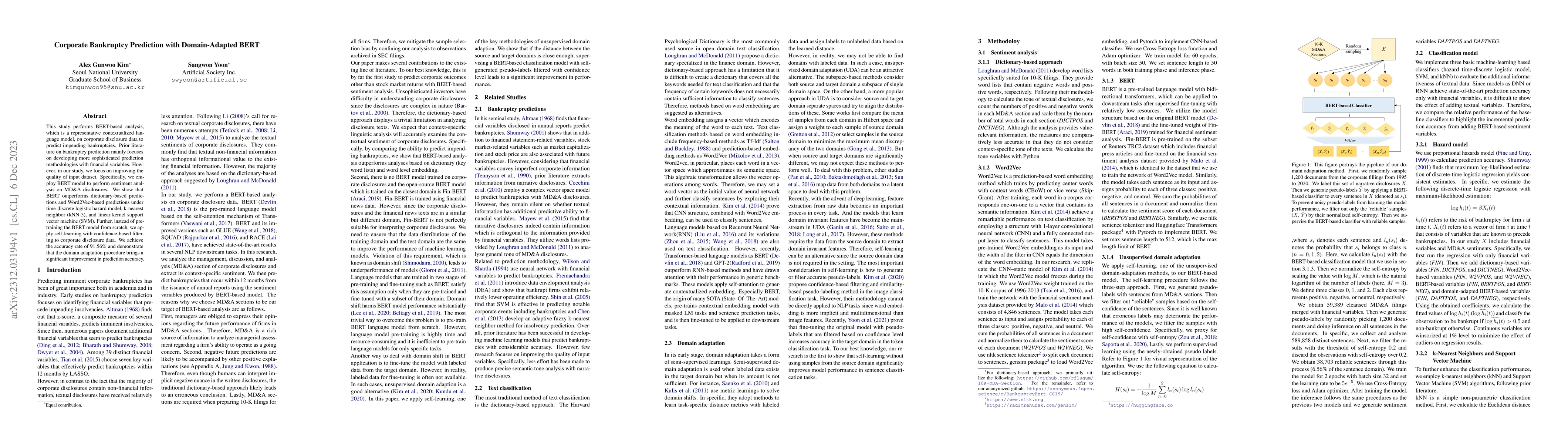

This study performs BERT-based analysis, which is a representative contextualized language model, on corporate disclosure data to predict impending bankruptcies. Prior literature on bankruptcy prediction mainly focuses on developing more sophisticated prediction methodologies with financial variables. However, in our study, we focus on improving the quality of input dataset. Specifically, we employ BERT model to perform sentiment analysis on MD&A disclosures. We show that BERT outperforms dictionary-based predictions and Word2Vec-based predictions in terms of adjusted R-square in logistic regression, k-nearest neighbor (kNN-5), and linear kernel support vector machine (SVM). Further, instead of pre-training the BERT model from scratch, we apply self-learning with confidence-based filtering to corporate disclosure data (10-K). We achieve the accuracy rate of 91.56% and demonstrate that the domain adaptation procedure brings a significant improvement in prediction accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAugmenting Bankruptcy Prediction using Reported Behavior of Corporate Restructuring

Xinlin Wang, Mats Brorsson

From Numbers to Words: Multi-Modal Bankruptcy Prediction Using the ECL Dataset

Thomas Demeester, Henri Arno, Klaas Mulier et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)