Summary

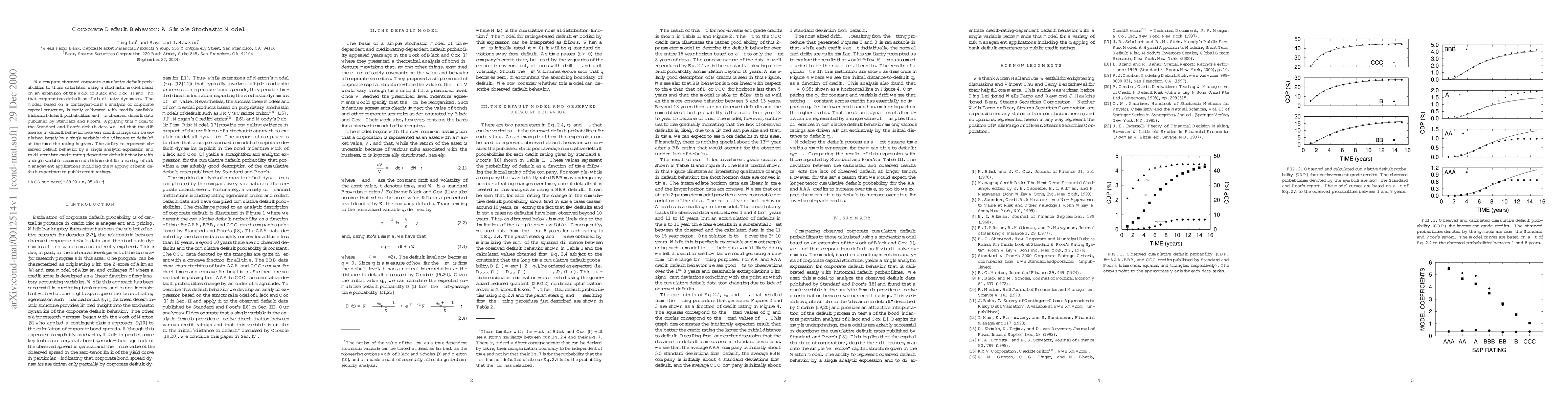

We compare observed corporate cumulative default probabilities to those calculated using a stochastic model based on an extension of the work of Black and Cox and find that corporations default as if via diffusive dynamics. The model, based on a contingent-claims analysis of corporate capital structure, is easily calibrated with readily available historical default probabilities and fits observed default data published by Standard and Poor's. Applying this model to the Standard and Poor's default data we find that the difference in default behavior between credit ratings can be explained largely by a single variable: the "distance to default" at the time the rating is given. The ability to represent observed default behavior by a single analytic expression and to differentiate credit-rating-dependent default behavior with a single variable recommends this model for a variety of risk management applications including the mapping of bank default experience to public credit ratings.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research employs a stochastic model based on an extension of Black and Cox's work, calibrated with historical default probabilities to fit Standard and Poor's default data.

Key Results

- Corporations default following diffusive dynamics, as observed data aligns with model predictions.

- Default behavior differences between credit ratings can be explained by the 'distance to default' at the time of rating.

- The model represents default behavior with a single analytic expression, differentiating credit-rating-dependent behavior using one variable.

Significance

This model is recommended for risk management applications, such as mapping bank default experience to public credit ratings, due to its ability to represent observed default behavior concisely.

Technical Contribution

The extension of Black and Cox's model to represent corporate default behavior stochastically, calibrated with readily available data.

Novelty

The model's ability to represent complex default behavior with a single variable distinguishing credit ratings sets it apart from existing research.

Limitations

- The model's applicability may be limited to the historical data used for calibration.

- It might not capture complex, non-diffusive default behaviors not observed in the data.

Future Work

- Explore the model's applicability to different economic conditions or industries.

- Investigate the incorporation of additional variables to capture more nuanced default behaviors.

Paper Details

PDF Preview

Similar Papers

Found 4 papersBayesian Estimation of Corporate Default Spreads

Maksim Papenkov, Beau Robinette

Comments (0)