Summary

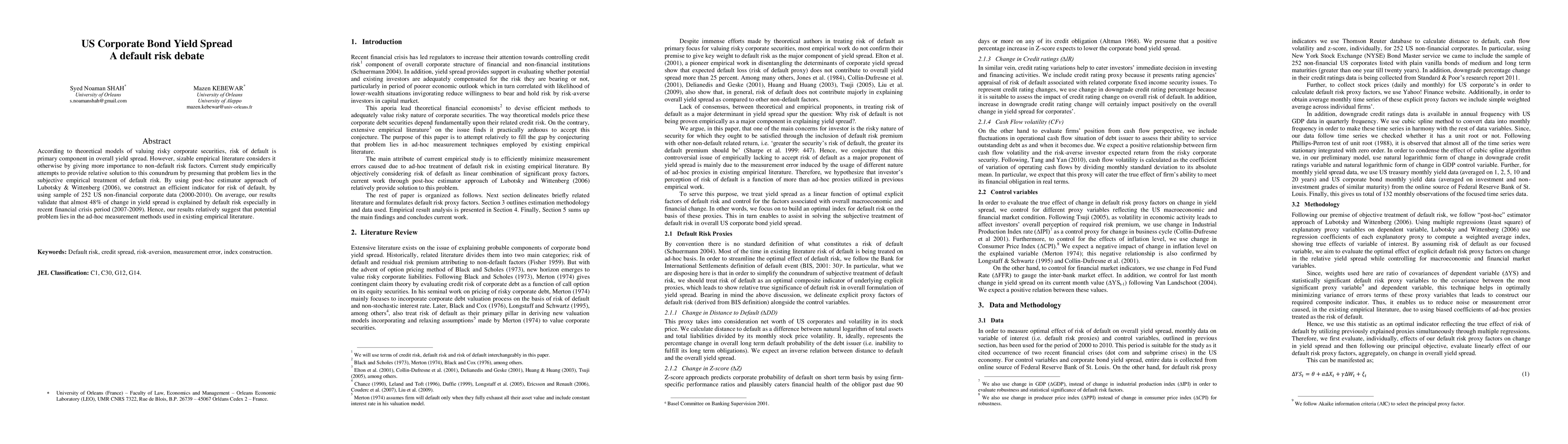

According to theoretical models of valuing risky corporate securities, risk of default is primary component in overall yield spread. However, sizable empirical literature considers it otherwise by giving more importance to non-default risk factors. Current study empirically attempts to provide relative solution to this conundrum by presuming that problem lies in the subjective empirical treatment of default risk. By using post-hoc estimator approach of Lubotsky & Wittenberg (2006), we construct an efficient indicator for risk of default, by using sample of 252 US non-financial corporate data (2000-2010). On average, our results validate that almost 48% of change in yield spread is explained by default risk especially in recent financial crisis period (2007-2009). Hence, our results relatively suggest that potential problem lies in the ad-hoc measurement methods used in existing empirical literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)