Authors

Summary

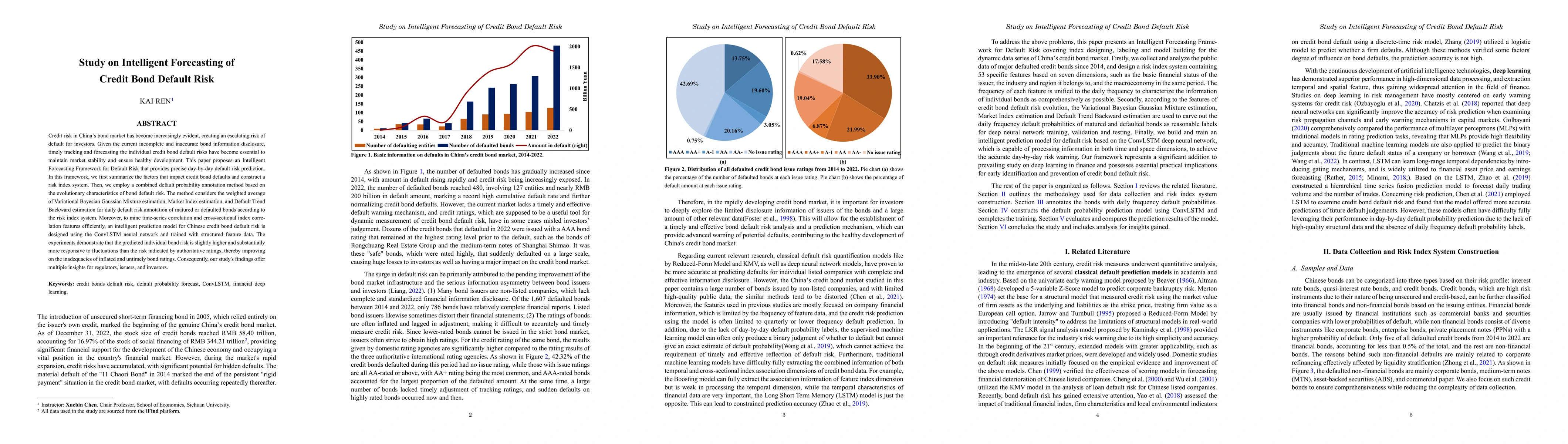

Credit risk in the China's bond market has become increasingly evident, creating a progressively escalating risk of default for credit bond investors. Given the current incomplete and inaccurate bond information disclosure, timely tracking and forecasting the individual credit bond default risks have become essential to maintain market stability and ensure healthy development. This paper proposes an Intelligent Forecasting Framework for Default Risk that provides precise day-by-day default risk prediction. In this framework, we first summarize the factors that impact credit bond defaults and construct a risk index system. Then, we employ a combined default probability annotation method based on the evolutionary characteristics of bond default risk. The method considers the weighted average of Variational Bayesian Gaussian Mixture estimation, Market Index estimation, and Default Trend Backward estimation for daily default risk annotation of matured or defaulted bonds according to the risk index system. Moreover, to mine time-series correlation and cross-sectional index correlation features efficiently, an intelligent prediction model for Chinese credit bond default risk is designed using the ConvLSTM neural network and trained with structured feature data. The experiments demonstrate that the predicted individual bond risk is slightly higher and substantially more responsive to fluctuations than the risk indicated by authoritative ratings, thereby improving on the inadequacies of inflated and untimely bond ratings. Consequently, this study's findings offer multiple insights for regulators, issuers, and investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalytical Pricing of 2 Factor Structural PDE model for a Puttable Bond with Credit Risk

Hyong Chol O, Dae Song Choe, Gyong-Dok Rim

No citations found for this paper.

Comments (0)