Summary

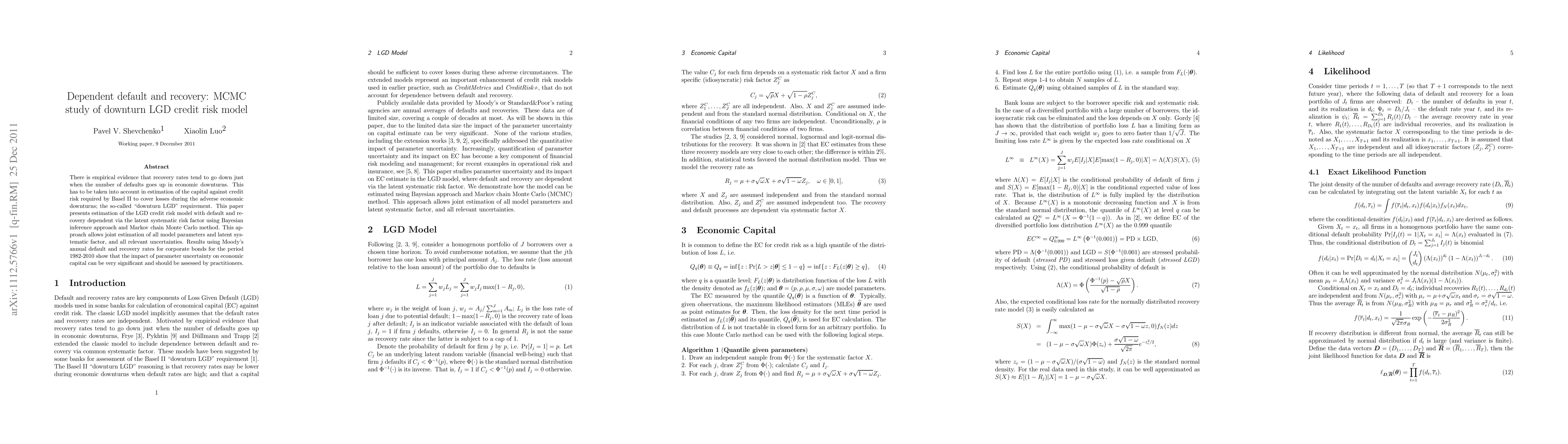

There is empirical evidence that recovery rates tend to go down just when the number of defaults goes up in economic downturns. This has to be taken into account in estimation of the capital against credit risk required by Basel II to cover losses during the adverse economic downturns; the so-called "downturn LGD" requirement. This paper presents estimation of the LGD credit risk model with default and recovery dependent via the latent systematic risk factor using Bayesian inference approach and Markov chain Monte Carlo method. This approach allows joint estimation of all model parameters and latent systematic factor, and all relevant uncertainties. Results using Moody's annual default and recovery rates for corporate bonds for the period 1982-2010 show that the impact of parameter uncertainty on economic capital can be very significant and should be assessed by practitioners.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)