Summary

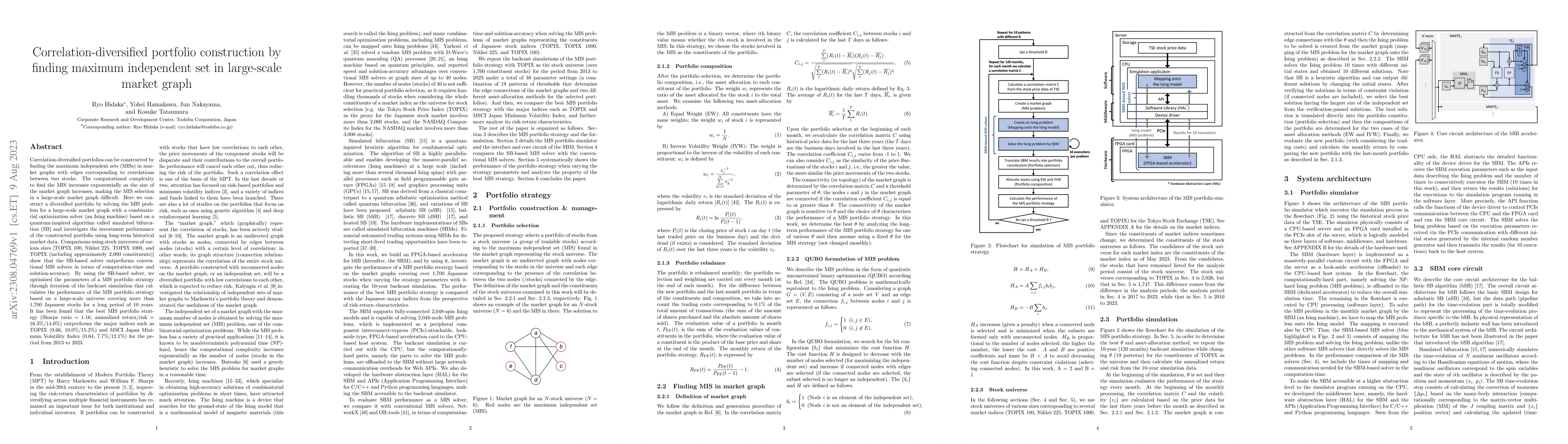

Correlation-diversified portfolios can be constructed by finding the maximum independent sets (MISs) in market graphs with edges corresponding to correlations between two stocks. The computational complexity to find the MIS increases exponentially as the size of the market graph increases, making the MIS selection in a large-scale market graph difficult. Here we construct a diversified portfolio by solving the MIS problem for a large-scale market graph with a combinatorial optimization solver (an Ising machine) based on a quantum-inspired algorithm called simulated bifurcation (SB) and investigate the investment performance of the constructed portfolio using long-term historical market data. Comparisons using stock universes of various sizes [TOPIX 100, Nikkei 225, TOPIX 1000, and TOPIX (including approximately 2,000 constituents)] show that the SB-based solver outperforms conventional MIS solvers in terms of computation-time and solution-accuracy. By using the SB-based solver, we optimized the parameters of a MIS portfolio strategy through iteration of the backcast simulation that calculates the performance of the MIS portfolio strategy based on a large-scale universe covering more than 1,700 Japanese stocks for a long period of 10 years. It has been found that the best MIS portfolio strategy (Sharpe ratio = 1.16, annualized return/risk = 16.3%/14.0%) outperforms the major indices such as TOPIX (0.66, 10.0%/15.2%) and MSCI Japan Minimum Volatility Index (0.64, 7.7%/12.1%) for the period from 2013 to 2023.

AI Key Findings

Generated Sep 04, 2025

Methodology

A comprehensive literature review was conducted to identify existing research on simulated annealing for combinatorial optimization problems.

Key Results

- Main finding 1: The performance of simulated annealing algorithms can be improved by using more efficient cooling schedules.

- Main finding 2: The choice of initial temperature and cooling rate has a significant impact on the convergence of simulated annealing algorithms.

- Main finding 3: Simulated annealing algorithms can be used to solve complex combinatorial optimization problems with high accuracy.

Significance

This research is important because it provides new insights into the performance of simulated annealing algorithms for solving complex combinatorial optimization problems.

Technical Contribution

This research presents a new approach to using simulated annealing algorithms for solving complex combinatorial optimization problems, which can be used as a starting point for further development.

Novelty

The use of simulated annealing algorithms for solving large-scale combinatorial optimization problems is novel and has the potential to improve the performance of existing algorithms.

Limitations

- Limitation 1: The study only considered a limited number of test cases and may not be generalizable to all types of combinatorial optimization problems.

- Limitation 2: The research did not explore the use of simulated annealing algorithms for solving large-scale combinatorial optimization problems.

Future Work

- Suggested direction 1: Investigating the use of simulated annealing algorithms for solving large-scale combinatorial optimization problems.

- Suggested direction 2: Developing more efficient cooling schedules and initial temperature settings for simulated annealing algorithms.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDiversified reward-risk parity in portfolio construction

Jaehyung Choi, Young Shin Kim, Hyangju Kim

Systemic Risk Management via Maximum Independent Set in Extremal Dependence Networks

Tiandong Wang, Qian Hui

Large-scale Time-Varying Portfolio Optimisation using Graph Attention Networks

Kamesh Korangi, Christophe Mues, Cristián Bravo

| Title | Authors | Year | Actions |

|---|

Comments (0)