Authors

Summary

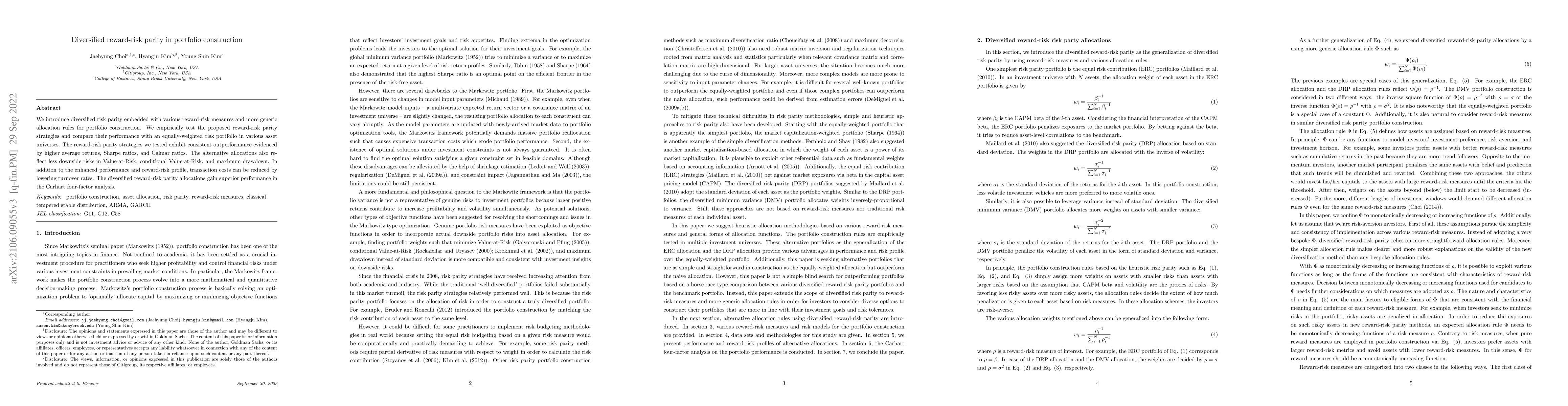

We introduce diversified risk parity embedded with various reward-risk measures and more generic allocation rules for portfolio construction. We empirically test the proposed reward-risk parity strategies and compare their performance with an equally-weighted risk portfolio in various asset universes. The reward-risk parity strategies we tested exhibit consistent outperformance evidenced by higher average returns, Sharpe ratios, and Calmar ratios. The alternative allocations also reflect less downside risks in Value-at-Risk, conditional Value-at-Risk, and maximum drawdown. In addition to the enhanced performance and reward-risk profile, transaction costs can be reduced by lowering turnover rates. The diversified reward-risk parity allocations gain superior performance in the Carhart four-factor analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)