Summary

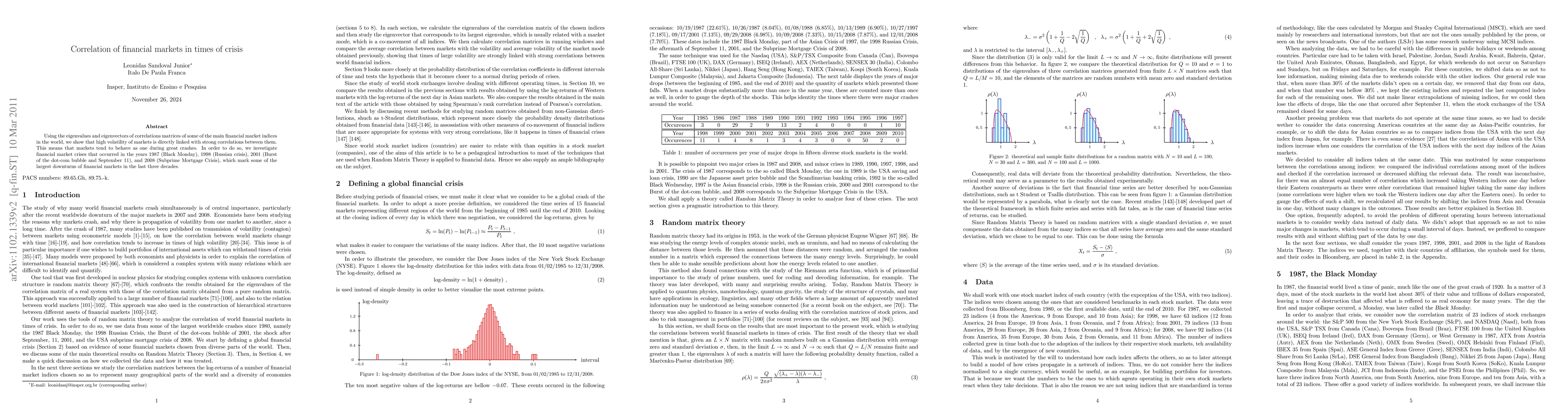

Using the eigenvalues and eigenvectors of correlations matrices of some of the main financial market indices in the world, we show that high volatility of markets is directly linked with strong correlations between them. This means that markets tend to behave as one during great crashes. In order to do so, we investigate several financial market crises that occurred in the years 1987 (Black Monday), 1989 (Russian crisis), 2001 (Burst of the dot-com bubble and September 11), and 2008 (Subprime Mortgage Crisis), which mark some of the largest downturns of financial markets in the last three decades.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)