Summary

Liberalization of electricity markets has increasingly created the need for understanding the volatility and correlation structure between electricity and financial markets. This work reveals the existence of structural changes in correlation patterns among these two markets and links the changes to both fundamentals and regulatory conditions prevailing in the markets, as well as the current European financial crisis. We apply a Dynamic Conditional Correlation (DCC) GARCH model to a set of market s fundamental variables and Greece s financial market and microeconomic indexes to study their interaction. Emphasis is given on the period of severe financial crisis of the Country to understand contagion and volatility spillover between these two markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

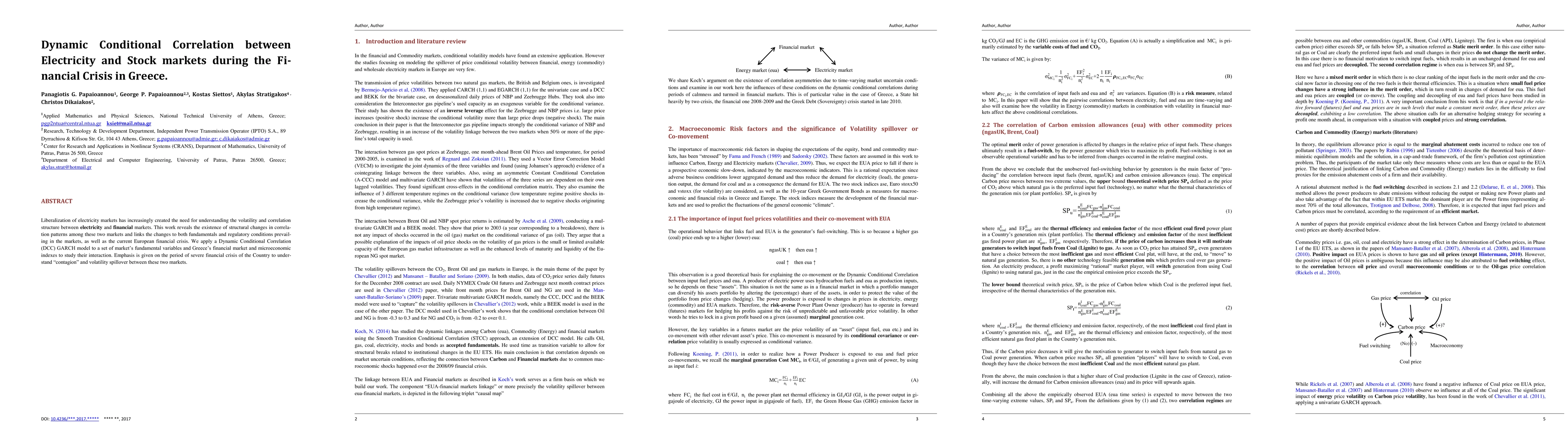

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)