Summary

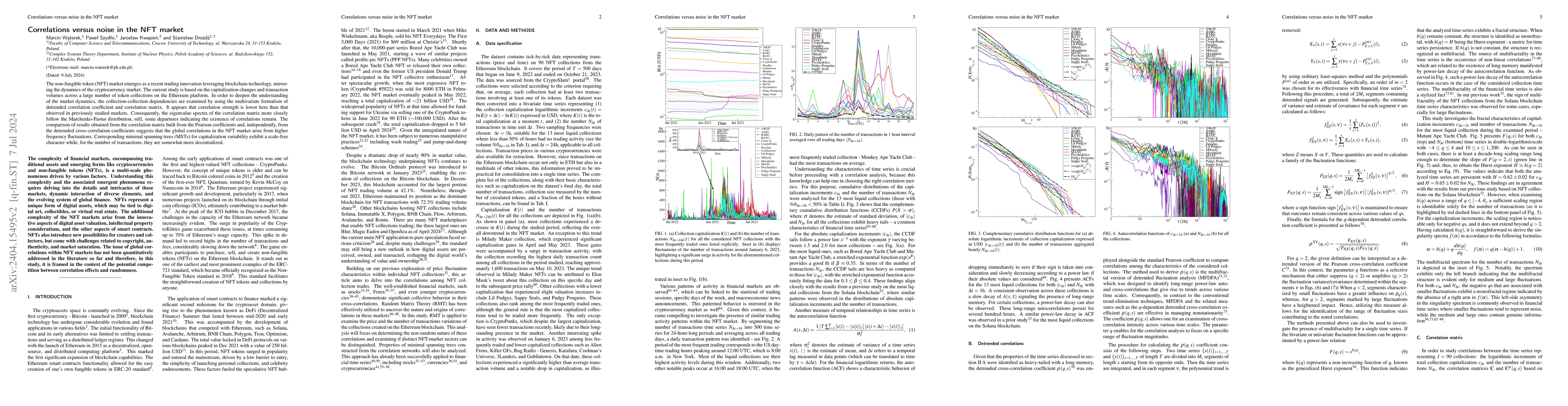

The non-fungible token (NFT) market emerges as a recent trading innovation leveraging blockchain technology, mirroring the dynamics of the cryptocurrency market. The current study is based on the capitalization changes and transaction volumes across a large number of token collections on the Ethereum platform. In order to deepen the understanding of the market dynamics, the collection-collection dependencies are examined by using the multivariate formalism of detrended correlation coefficient and correlation matrix. It appears that correlation strength is lower here than that observed in previously studied markets. Consequently, the eigenvalue spectra of the correlation matrix more closely follow the Marchenko-Pastur distribution, still, some departures indicating the existence of correlations remain. The comparison of results obtained from the correlation matrix built from the Pearson coefficients and, independently, from the detrended cross-correlation coefficients suggests that the global correlations in the NFT market arise from higher frequency fluctuations. Corresponding minimal spanning trees (MSTs) for capitalization variability exhibit a scale-free character while, for the number of transactions, they are somewhat more decentralized.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)