Summary

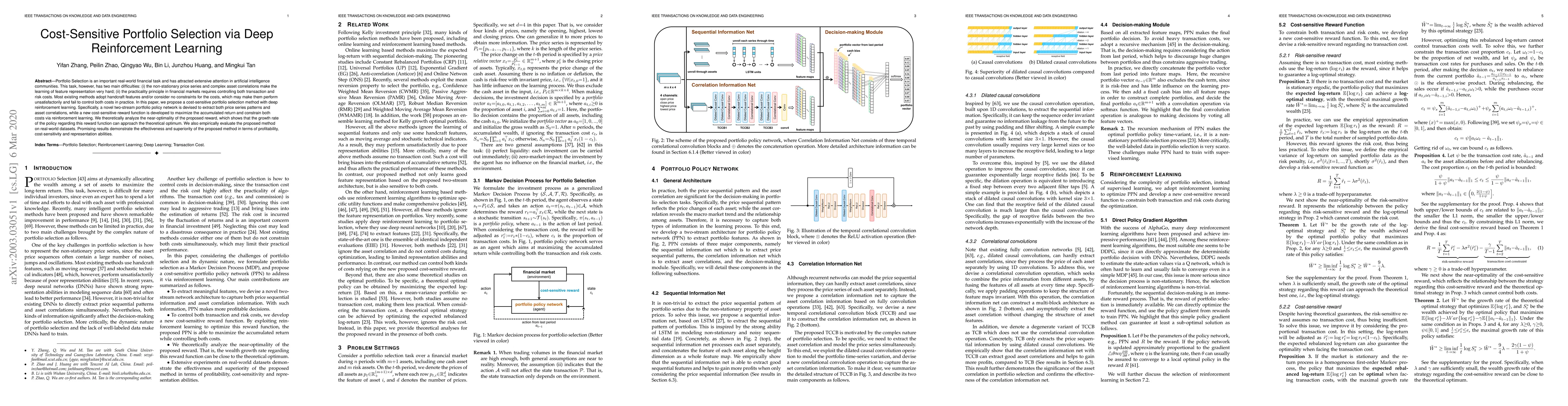

Portfolio Selection is an important real-world financial task and has attracted extensive attention in artificial intelligence communities. This task, however, has two main difficulties: (i) the non-stationary price series and complex asset correlations make the learning of feature representation very hard; (ii) the practicality principle in financial markets requires controlling both transaction and risk costs. Most existing methods adopt handcraft features and/or consider no constraints for the costs, which may make them perform unsatisfactorily and fail to control both costs in practice. In this paper, we propose a cost-sensitive portfolio selection method with deep reinforcement learning. Specifically, a novel two-stream portfolio policy network is devised to extract both price series patterns and asset correlations, while a new cost-sensitive reward function is developed to maximize the accumulated return and constrain both costs via reinforcement learning. We theoretically analyze the near-optimality of the proposed reward, which shows that the growth rate of the policy regarding this reward function can approach the theoretical optimum. We also empirically evaluate the proposed method on real-world datasets. Promising results demonstrate the effectiveness and superiority of the proposed method in terms of profitability, cost-sensitivity and representation abilities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBenchmarking Robustness of Deep Reinforcement Learning approaches to Online Portfolio Management

Fabrice Popineau, Arpad Rimmel, Bich-Liên Doan et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)