Authors

Summary

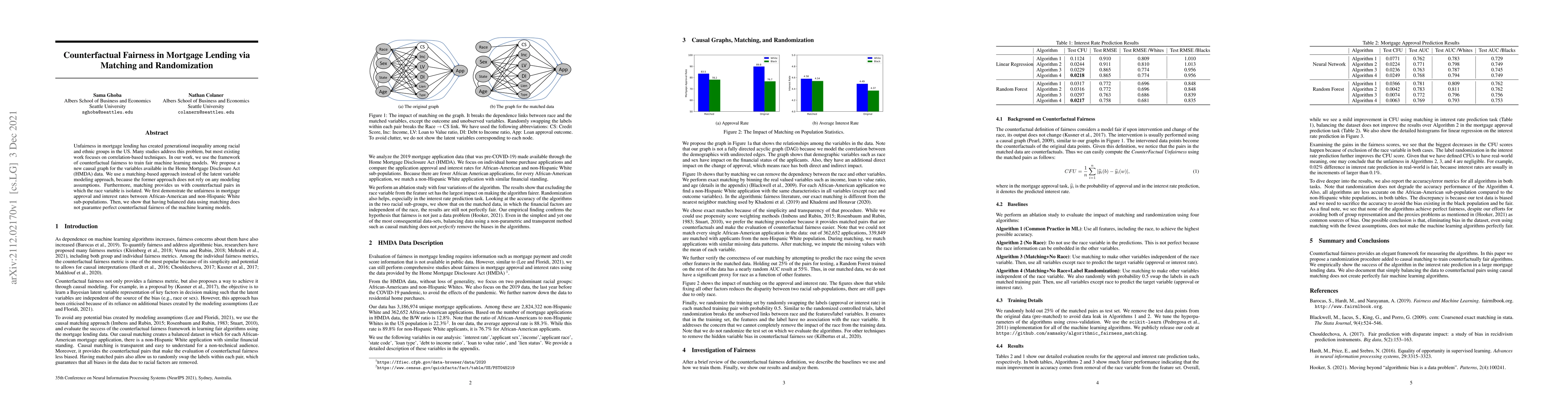

Unfairness in mortgage lending has created generational inequality among racial and ethnic groups in the US. Many studies address this problem, but most existing work focuses on correlation-based techniques. In our work, we use the framework of counterfactual fairness to train fair machine learning models. We propose a new causal graph for the variables available in the Home Mortgage Disclosure Act (HMDA) data. We use a matching-based approach instead of the latent variable modeling approach, because the former approach does not rely on any modeling assumptions. Furthermore, matching provides us with counterfactual pairs in which the race variable is isolated. We first demonstrate the unfairness in mortgage approval and interest rates between African-American and non-Hispanic White sub-populations. Then, we show that having balanced data using matching does not guarantee perfect counterfactual fairness of the machine learning models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRacial and Ethnic Disparities in Mortgage Lending: New Evidence from Expanded HMDA Data

Nicholas Tenev, Sean Lewis-Faupel

Lookahead Counterfactual Fairness

Mohammad Mahdi Khalili, Tian Xie, Xueru Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)