Authors

Summary

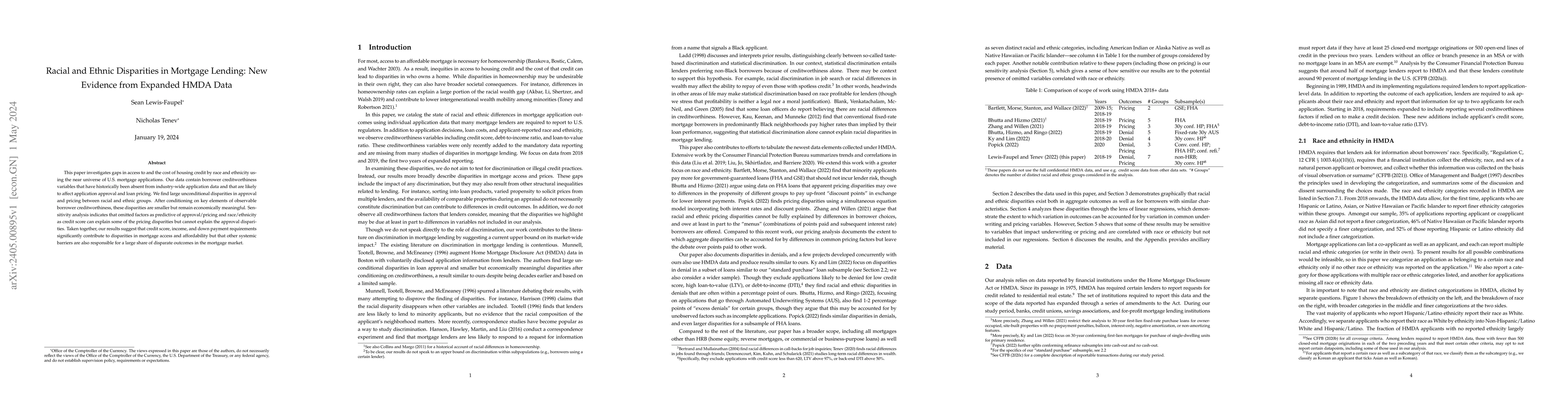

This paper investigates gaps in access to and the cost of housing credit by race and ethnicity using the near universe of U.S. mortgage applications. Our data contain borrower creditworthiness variables that have historically been absent from industry-wide application data and that are likely to affect application approval and loan pricing. We find large unconditional disparities in approval and pricing between racial and ethnic groups. After conditioning on key elements of observable borrower creditworthiness, these disparities are smaller but remain economically meaningful. Sensitivity analysis indicates that omitted factors as predictive of approval/pricing and race/ethnicity as credit score can explain some of the pricing disparities but cannot explain the approval disparities. Taken together, our results suggest that credit score, income, and down payment requirements significantly contribute to disparities in mortgage access and affordability but that other systemic barriers are also responsible for a large share of disparate outcomes in the mortgage market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCounterfactual Fairness in Mortgage Lending via Matching and Randomization

Sama Ghoba, Nathan Colaner

Racial/Ethnic Disparities in Suicide Attempt Risk in New York City Female Youth

Emery, K. J., Sheftall, A., Dixon, J. et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)