Summary

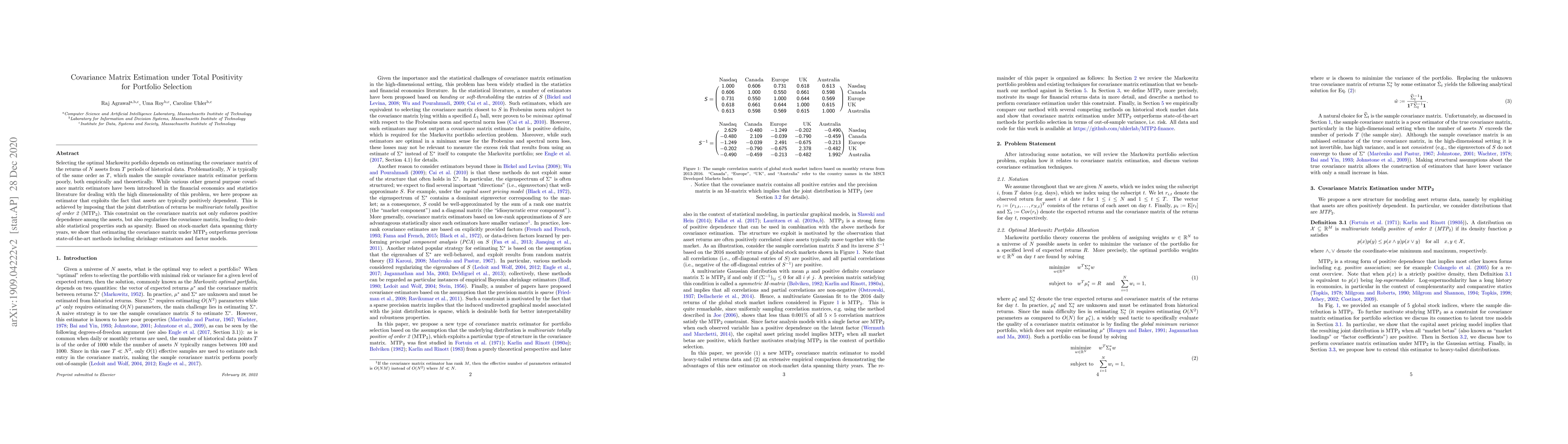

Selecting the optimal Markowitz porfolio depends on estimating the covariance matrix of the returns of $N$ assets from $T$ periods of historical data. Problematically, $N$ is typically of the same order as $T$, which makes the sample covariance matrix estimator perform poorly, both empirically and theoretically. While various other general purpose covariance matrix estimators have been introduced in the financial economics and statistics literature for dealing with the high dimensionality of this problem, we here propose an estimator that exploits the fact that assets are typically positively dependent. This is achieved by imposing that the joint distribution of returns be multivariate totally positive of order 2 ($\text{MTP}_2$). This constraint on the covariance matrix not only enforces positive dependence among the assets, but also regularizes the covariance matrix, leading to desirable statistical properties such as sparsity. Based on stock-market data spanning over thirty years, we show that estimating the covariance matrix under $\text{MTP}_2$ outperforms previous state-of-the-art methods including shrinkage estimators and factor models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)