Summary

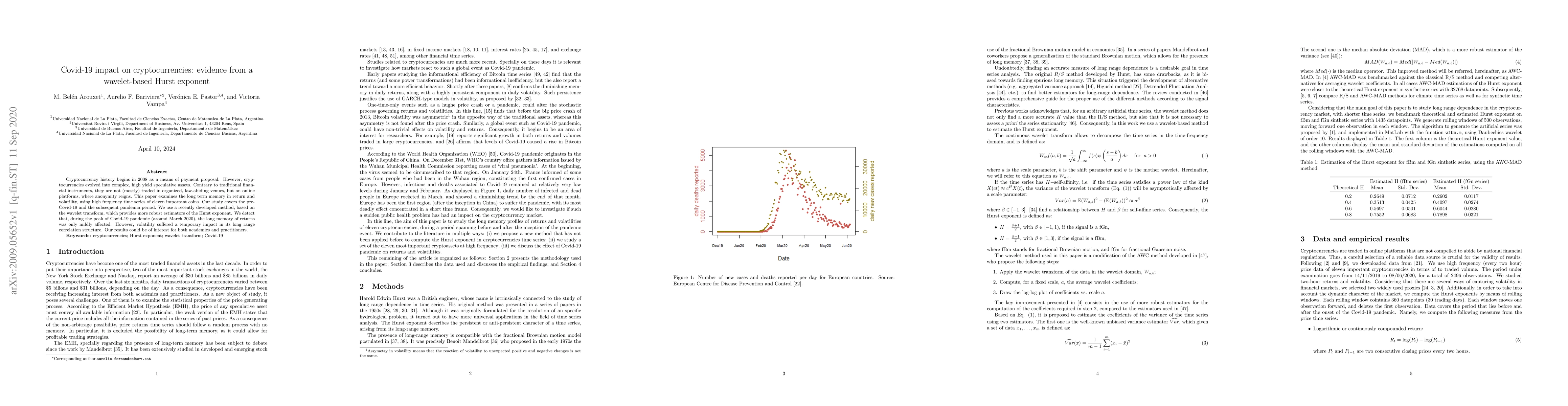

Cryptocurrency history begins in 2008 as a means of payment proposal. However, cryptocurrencies evolved into complex, high yield speculative assets. Contrary to traditional financial instruments, they are not (mostly) traded in organized, law-abiding venues, but on online platforms, where anonymity reigns. This paper examines the long term memory in return and volatility, using high frequency time series of eleven important coins. Our study covers the pre-Covid-19 and the subsequent pandemia period. We use a recently developed method, based on the wavelet transform, which provides more robust estimators of the Hurst exponent. We detect that, during the peak of Covid-19 pandemic (around March 2020), the long memory of returns was only mildly affected. However, volatility suffered a temporary impact in its long range correlation structure. Our results could be of interest for both academics and practitioners.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)