Authors

Summary

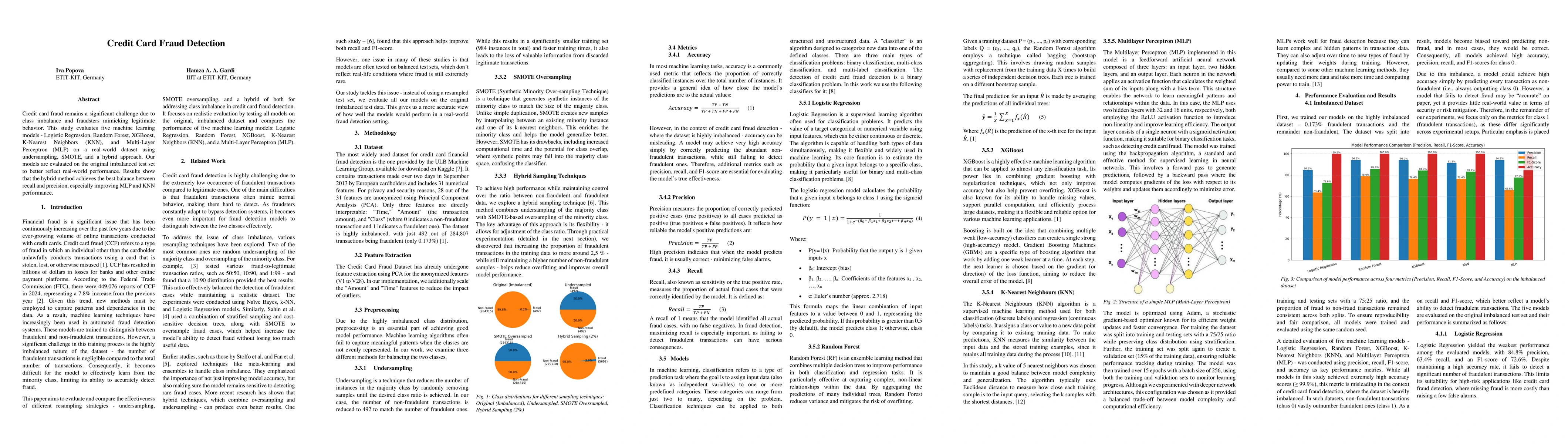

Credit card fraud remains a significant challenge due to class imbalance and fraudsters mimicking legitimate behavior. This study evaluates five machine learning models - Logistic Regression, Random Forest, XGBoost, K-Nearest Neighbors (KNN), and Multi-Layer Perceptron (MLP) on a real-world dataset using undersampling, SMOTE, and a hybrid approach. Our models are evaluated on the original imbalanced test set to better reflect real-world performance. Results show that the hybrid method achieves the best balance between recall and precision, especially improving MLP and KNN performance.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study evaluated five machine learning models (Logistic Regression, Random Forest, XGBoost, KNN, and MLP) on a credit card fraud dataset using undersampling, SMOTE, and a hybrid approach. Models were tested on both balanced and original imbalanced datasets to assess real-world performance.

Key Results

- The hybrid sampling method achieved the best balance between recall and precision, especially improving MLP and KNN performance.

- Random Forest showed the highest F1-score (85.8%) on the original imbalanced dataset, followed by XGBoost (84.3%) and KNN (83.2%).

- MLP had the highest precision (94.2%) but lower recall (65.8%) on the original dataset, indicating a trade-off between false positives and fraud detection.

Significance

This research is important for improving credit card fraud detection systems by addressing class imbalance, which is critical for real-world applications where fraudulent transactions are rare. The findings help in selecting appropriate models and sampling techniques to enhance fraud detection accuracy and reliability.

Technical Contribution

The study provides a comprehensive comparison of sampling techniques (undersampling, SMOTE, hybrid) and their impact on model performance, offering practical insights for credit card fraud detection.

Novelty

The hybrid approach combining SMOTE and undersampling was tested across multiple models, demonstrating its effectiveness in improving recall while maintaining reasonable precision for real-world imbalanced datasets.

Limitations

- The study focuses on a single dataset, which may limit generalizability to other fraud detection scenarios.

- Performance metrics were evaluated on specific metrics (precision, recall, F1-score), which may not capture all aspects of fraud detection effectiveness.

Future Work

- Exploring more advanced deep learning architectures for better fraud pattern recognition.

- Investigating the impact of temporal data and transaction sequences on fraud detection models.

Paper Details

PDF Preview

Similar Papers

Found 5 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

Detection and Impact of Debit/Credit Card Fraud: Victims' Experiences

Eman Alashwali, Lorrie Faith Cranor, Ragashree Mysuru Chandrashekar et al.

Comments (0)