Summary

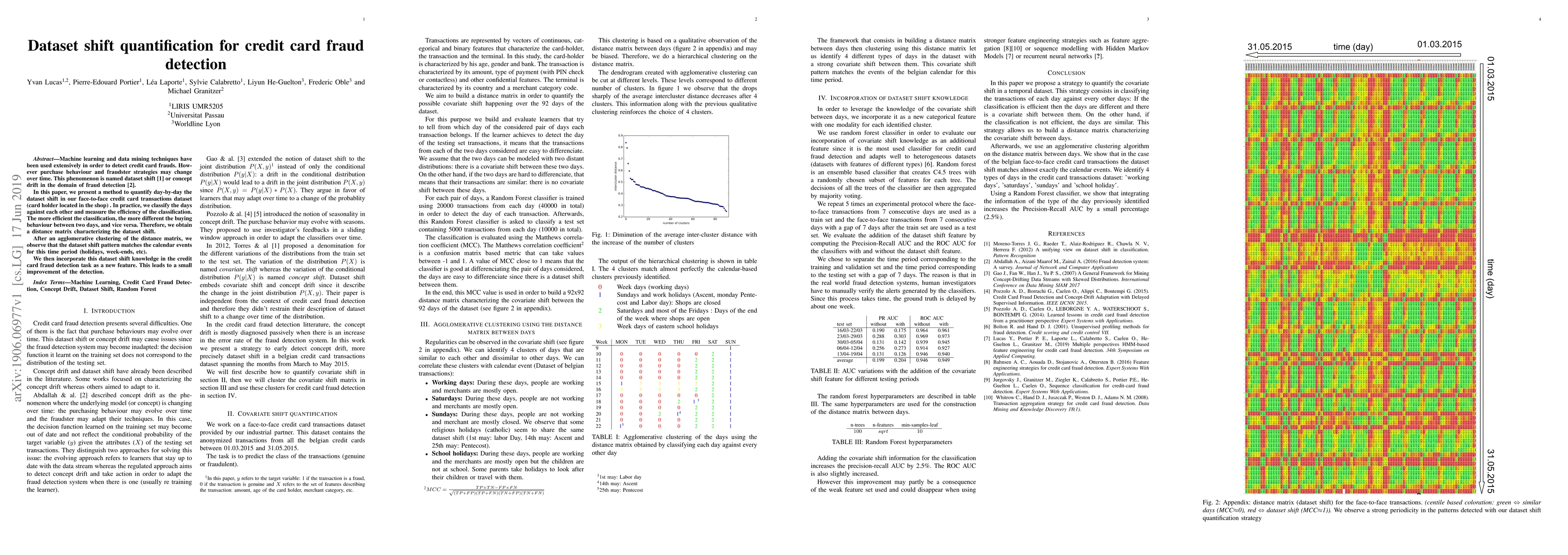

Machine learning and data mining techniques have been used extensively in order to detect credit card frauds. However purchase behaviour and fraudster strategies may change over time. This phenomenon is named dataset shift or concept drift in the domain of fraud detection. In this paper, we present a method to quantify day-by-day the dataset shift in our face-to-face credit card transactions dataset (card holder located in the shop) . In practice, we classify the days against each other and measure the efficiency of the classification. The more efficient the classification, the more different the buying behaviour between two days, and vice versa. Therefore, we obtain a distance matrix characterizing the dataset shift. After an agglomerative clustering of the distance matrix, we observe that the dataset shift pattern matches the calendar events for this time period (holidays, week-ends, etc). We then incorporate this dataset shift knowledge in the credit card fraud detection task as a new feature. This leads to a small improvement of the detection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

Locally Interpretable One-Class Anomaly Detection for Credit Card Fraud Detection

Tungyu Wu, Youting Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)