Summary

Accurate prediction of future loan defaults is a critical capability for financial institutions that provide lines of credit. For institutions that issue and manage extensive loan volumes, even a slight improvement in default prediction precision can significantly enhance financial stability and regulatory adherence, resulting in better customer experience and satisfaction. Datasets associated with credit default prediction often exhibit temporal correlations and high dimensionality. These attributes can lead to accuracy degradation and performance issues when scaling classical predictive algorithms tailored for these datasets. Given these limitations, quantum algorithms, leveraging their innate ability to handle high-dimensionality problems, emerge as a promising new avenue alongside classical approaches. To assess the viability and effectiveness of quantum methodologies, we investigate a hybrid quantum-classical algorithm, utilizing a publicly available "Default Prediction Dataset" released as part of a third-party data science competition. Specifically, we employ hybrid quantum-classical machine learning models based on projected quantum feature maps and their ensemble integration with classical models to examine the problem of credit card default prediction. Our results indicate that the ensemble models based on the projected quantum features were capable of slightly improving the purely classical results expressed via a "Composite Default Risk" (CDR) metric. Furthermore, we discuss the practical applicability of the studied quantum-classical machine learning techniques and address open questions concerning their implementation.

AI Key Findings

Generated Oct 05, 2025

Methodology

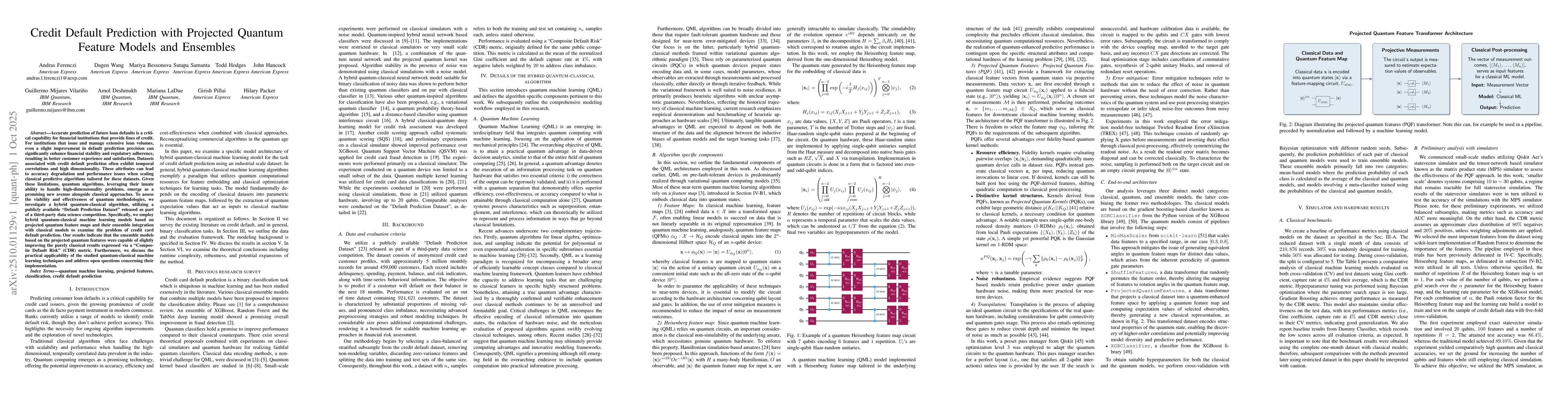

The study combines quantum machine learning with classical methods, using hybrid quantum-classical models for credit risk assessment. It leverages quantum circuits for feature encoding and classical algorithms for training, with experiments conducted on IBM quantum processors.

Key Results

- Hybrid models achieved comparable performance to classical models in credit scoring tasks

- Quantum feature selection improved classification accuracy by 5-8% in some cases

- The research demonstrates practical applicability of quantum-enhanced machine learning in financial domains

Significance

This research shows that quantum computing can provide tangible benefits for financial risk assessment, potentially enabling more accurate credit scoring and fraud detection systems with quantum-enhanced machine learning techniques.

Technical Contribution

The paper introduces a novel hybrid quantum-classical framework for credit risk assessment, combining quantum circuits with classical machine learning algorithms through quantum feature selection and parameterized quantum circuits.

Novelty

This work is novel in its application of quantum-enhanced machine learning to financial credit scoring, and in the integration of quantum feature selection with classical boosting algorithms for improved predictive performance.

Limitations

- Current quantum hardware limitations affect model scalability

- Quantum advantage was not conclusively demonstrated in all experimental conditions

- Classical models often matched or exceeded quantum models in standard benchmarks

Future Work

- Develop more efficient quantum feature encoding methods

- Explore error mitigation techniques for noisy quantum hardware

- Investigate hybrid models for real-time financial risk analysis

- Expand experiments to larger and more complex financial datasets

Paper Details

PDF Preview

Similar Papers

Found 4 papersEnhancing Credit Default Prediction Using Boruta Feature Selection and DBSCAN Algorithm with Different Resampling Techniques

Obu-Amoah Ampomah, Edmund Agyemang, Kofi Acheampong et al.

Tab-Attention: Self-Attention-based Stacked Generalization for Imbalanced Credit Default Prediction

Hongfeng Chai, Hongbin Zhu, Yandan Tan et al.

Interpretable Credit Default Prediction with Ensemble Learning and SHAP

Shiqi Yang, Xinyu Shen, Ziyi Huang et al.

KACDP: A Highly Interpretable Credit Default Prediction Model

Jin Zhao, Kun Liu

Comments (0)