Summary

Through a long-period analysis of the inter-temporal relations between the French markets for credit default swaps (CDS), shares and bonds between 2001 and 2008, this article shows how a financial innovation like CDS could heighten financial instability. After describing the operating principles of credit derivatives in general and CDS in particular, we construct two difference VAR models on the series: the share return rates, the variation in bond spreads and the variation in CDS spreads for thirteen French companies, with the aim of bringing to light the relations between these three markets. According to these models, there is indeed an interdependence between the French share, CDS and bond markets, with a strong influence of the share market on the other two. This interdependence increases during periods of tension on the markets (2001-2002, and since the summer of 2007).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

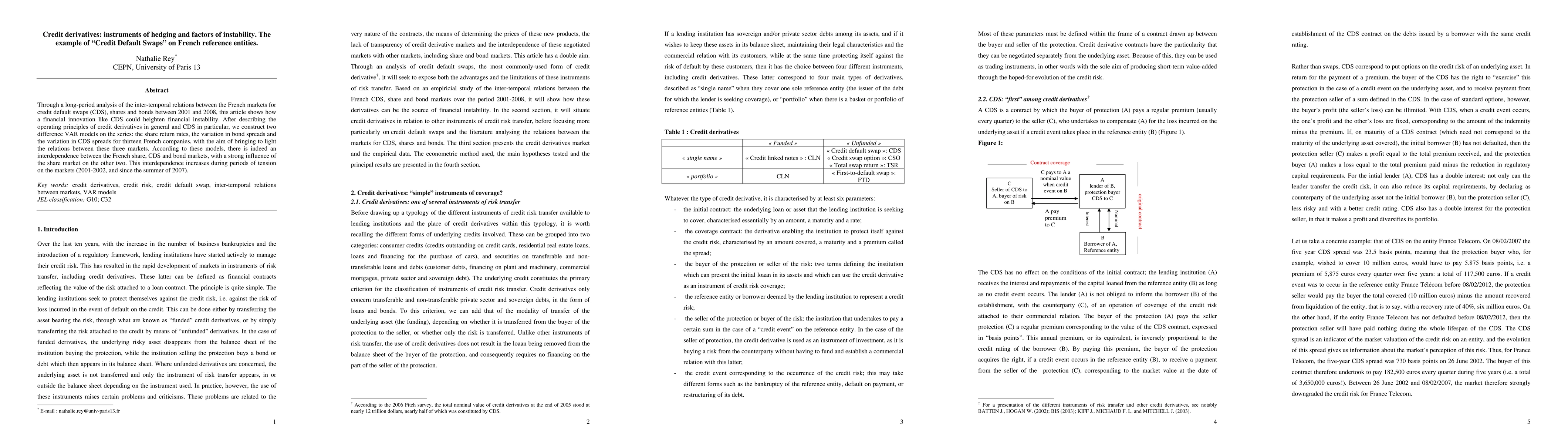

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)