Summary

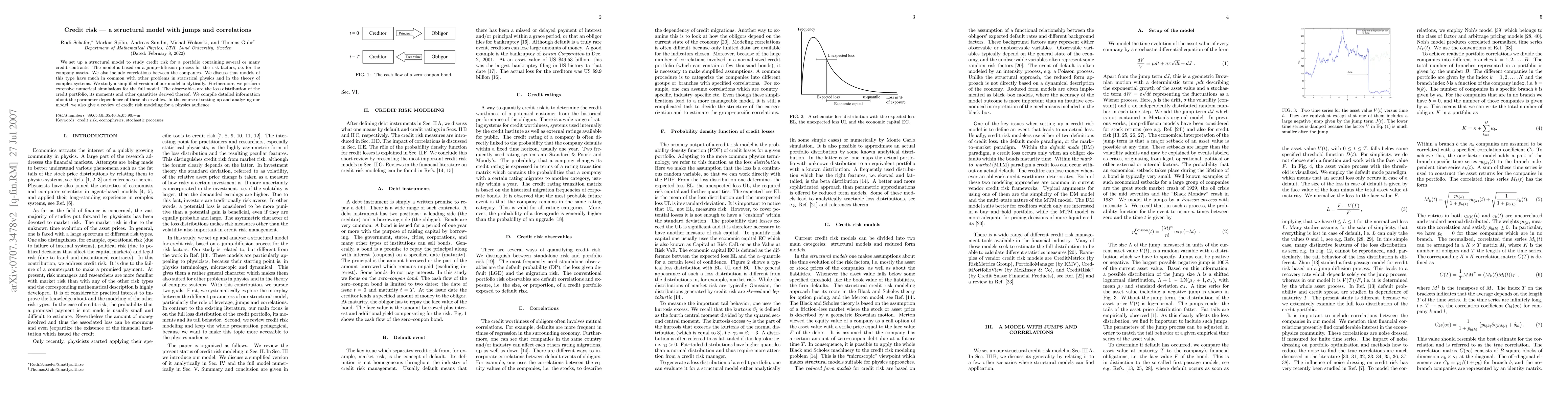

We set up a structural model to study credit risk for a portfolio containing several or many credit contracts. The model is based on a jump--diffusion process for the risk factors, i.e. for the company assets. We also include correlations between the companies. We discuss that models of this type have much in common with other problems in statistical physics and in the theory of complex systems. We study a simplified version of our model analytically. Furthermore, we perform extensive numerical simulations for the full model. The observables are the loss distribution of the credit portfolio, its moments and other quantities derived thereof. We compile detailed information about the parameter dependence of these observables. In the course of setting up and analyzing our model, we also give a review of credit risk modeling for a physics audience.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA contagion process with self-exciting jumps in credit risk applications

Puneet Pasricha, Dharmaraja Selvamuthu, Selvaraju Natarajan

Analytical Pricing of 2 Factor Structural PDE model for a Puttable Bond with Credit Risk

Hyong Chol O, Dae Song Choe, Gyong-Dok Rim

| Title | Authors | Year | Actions |

|---|

Comments (0)