Authors

Summary

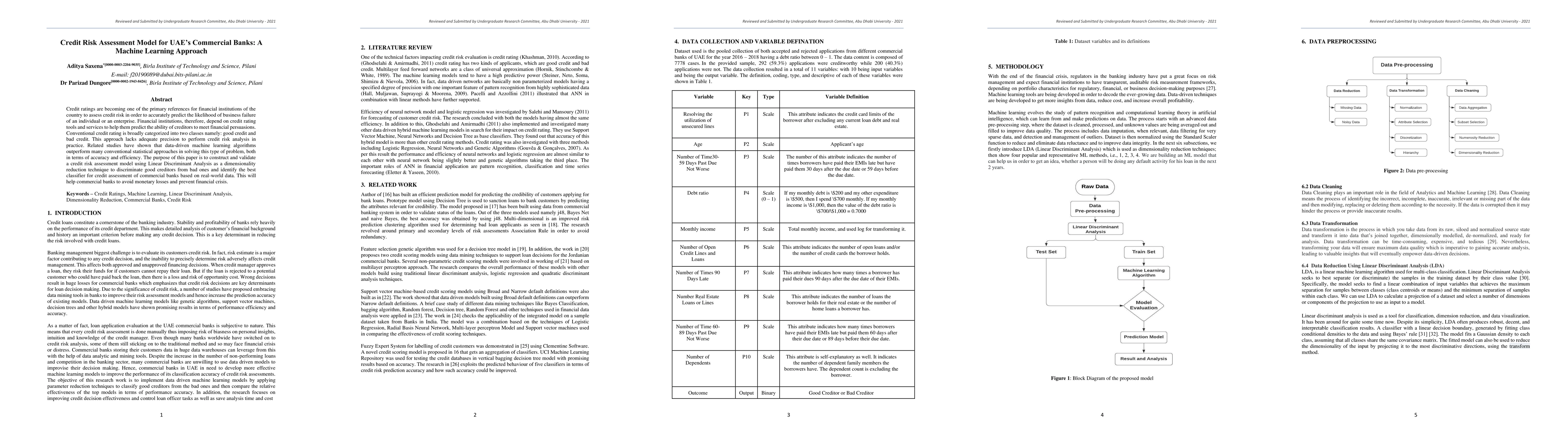

Credit ratings are becoming one of the primary references for financial institutions of the country to assess credit risk in order to accurately predict the likelihood of business failure of an individual or an enterprise. Financial institutions, therefore, depend on credit rating tools and services to help them predict the ability of creditors to meet financial persuasions. Conventional credit rating is broadly categorized into two classes namely: good credit and bad credit. This approach lacks adequate precision to perform credit risk analysis in practice. Related studies have shown that data-driven machine learning algorithms outperform many conventional statistical approaches in solving this type of problem, both in terms of accuracy and efficiency. The purpose of this paper is to construct and validate a credit risk assessment model using Linear Discriminant Analysis as a dimensionality reduction technique to discriminate good creditors from bad ones and identify the best classifier for credit assessment of commercial banks based on real-world data. This will help commercial banks to avoid monetary losses and prevent financial crisis

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersResearch on Credit Risk Early Warning Model of Commercial Banks Based on Neural Network Algorithm

Yu Cheng, Liyang Wang, Ao Xiang et al.

Efficient Commercial Bank Customer Credit Risk Assessment Based on LightGBM and Feature Engineering

Yanjie Sun, Quan Shi, Lin Chen et al.

No citations found for this paper.

Comments (0)