Authors

Summary

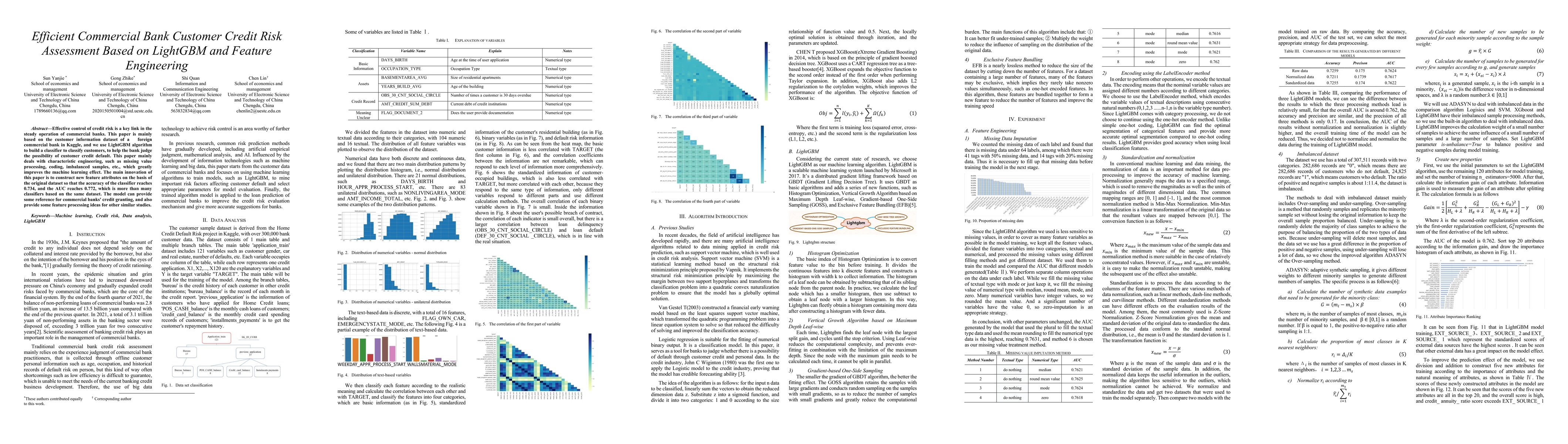

Effective control of credit risk is a key link in the steady operation of commercial banks. This paper is mainly based on the customer information dataset of a foreign commercial bank in Kaggle, and we use LightGBM algorithm to build a classifier to classify customers, to help the bank judge the possibility of customer credit default. This paper mainly deals with characteristic engineering, such as missing value processing, coding, imbalanced samples, etc., which greatly improves the machine learning effect. The main innovation of this paper is to construct new feature attributes on the basis of the original dataset so that the accuracy of the classifier reaches 0.734, and the AUC reaches 0.772, which is more than many classifiers based on the same dataset. The model can provide some reference for commercial banks' credit granting, and also provide some feature processing ideas for other similar studies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUtilizing the LightGBM Algorithm for Operator User Credit Assessment Research

Bo Dang, Yulu Gong, Danqing Ma et al.

Credit Risk Assessment Model for UAE Commercial Banks: A Machine Learning Approach

Aditya Saxena, Dr Parizad Dungore

Advanced User Credit Risk Prediction Model using LightGBM, XGBoost and Tabnet with SMOTEENN

Chang Yu, Yixin Jin, Qianwen Xing et al.

Research on Credit Risk Early Warning Model of Commercial Banks Based on Neural Network Algorithm

Yu Cheng, Liyang Wang, Ao Xiang et al.

No citations found for this paper.

Comments (0)