Authors

Summary

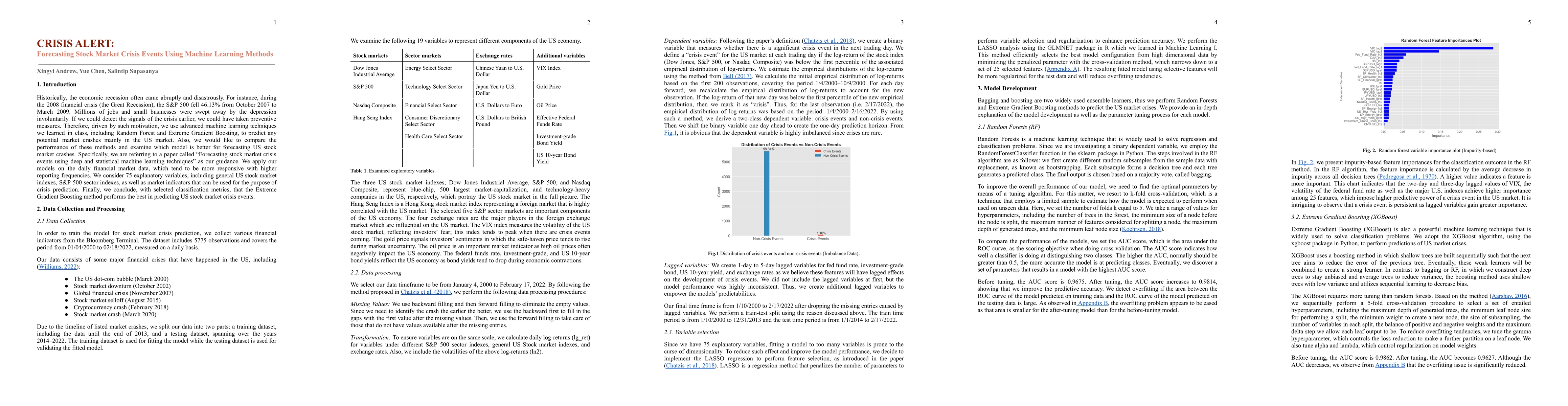

Historically, the economic recession often came abruptly and disastrously. For instance, during the 2008 financial crisis, the SP 500 fell 46 percent from October 2007 to March 2009. If we could detect the signals of the crisis earlier, we could have taken preventive measures. Therefore, driven by such motivation, we use advanced machine learning techniques, including Random Forest and Extreme Gradient Boosting, to predict any potential market crashes mainly in the US market. Also, we would like to compare the performance of these methods and examine which model is better for forecasting US stock market crashes. We apply our models on the daily financial market data, which tend to be more responsive with higher reporting frequencies. We consider 75 explanatory variables, including general US stock market indexes, SP 500 sector indexes, as well as market indicators that can be used for the purpose of crisis prediction. Finally, we conclude, with selected classification metrics, that the Extreme Gradient Boosting method performs the best in predicting US stock market crisis events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine Learning Methods for Evaluating Public Crisis: Meta-Analysis

Jess Kropczynski, Izunna Okpala, Shane Halse

The Ethical Risks of Analyzing Crisis Events on Social Media with Machine Learning

Ricardo Usbeck, Angelie Kraft

| Title | Authors | Year | Actions |

|---|

Comments (0)