Summary

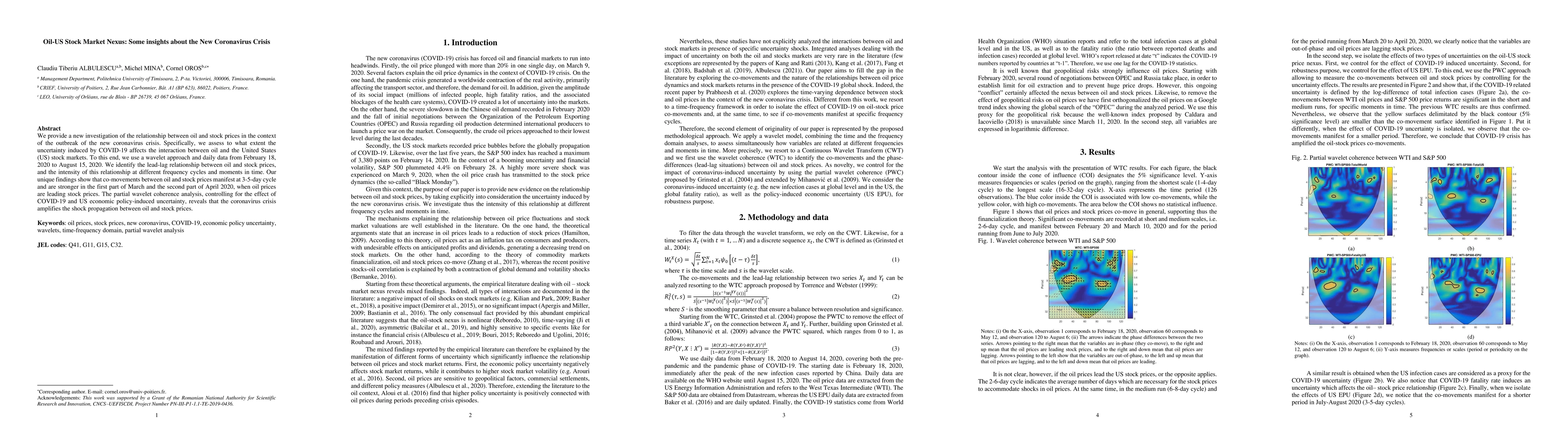

We provide a new investigation of the relationship between oil and stock prices in the context of the outbreak of the new coronavirus crisis. Specifically, we assess to what extent the uncertainty induced by COVID-19 affects the interaction between oil and the United States (US) stock markets. To this end, we use a wavelet approach and daily data from February 18, 2020 to August 15, 2020. We identify the lead-lag relationship between oil and stock prices, and the intensity of this relationship at different frequency cycles and moments in time. Our unique findings show that co-movements between oil and stock prices manifest at 3-5-day cycle and are stronger in the first part of March and the second part of April 2020, when oil prices are leading stock prices. The partial wavelet coherence analysis, controlling for the effect of COVID-19 and US economic policy-induced uncertainty, reveals that the coronavirus crisis amplifies the shock propagation between oil and stock prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCRISIS ALERT:Forecasting Stock Market Crisis Events Using Machine Learning Methods

Yue Chen, Xingyi Andrew, Salintip Supasanya

| Title | Authors | Year | Actions |

|---|

Comments (0)